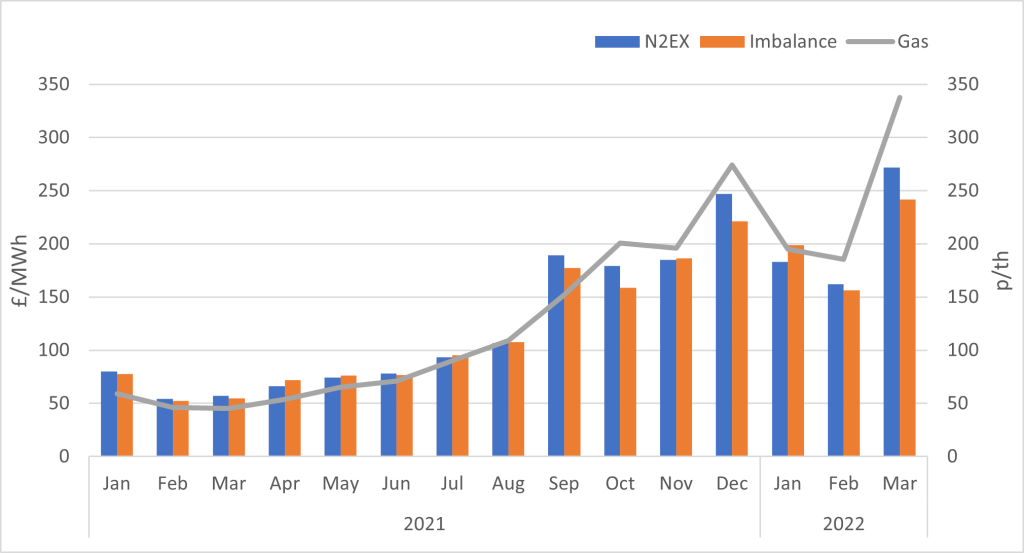

Since Growsave’s last look at energy prices, the exponentially increasing trend has broken. Despite this, several cases of extreme price spikes have continued to occur; imbalance electricity prices reached £4,036/MWh in January 2022, day-ahead N2EX electricity prices just topped £2,000/MWh in mid-November 2021, and day-ahead gas reached as high as 600 p/th in early March 2022.

This is partly down to the continued geopolitical and infrastructural market pressures outlined in previous articles, and again has been largely weather driven. Although much of December 2021 was unusually mild, the lack of wind and very dull overcast days resulted in poor renewable generation which drove energy prices upwards. January 2022 then returned towards price levels seen in November 2021, but electricity prices continued to be more than twice as high as the same time last year, and gas prices more than three times higher.

Particularly affecting the gas market price is the current Russia-Ukraine situation. While the UK only imports a small amount of gas from Russia, the EU is much more dependent on Russian imports. Uncertainty around sanctions and the reliability of Russian gas trading caused a large peak in gas prices in early March 2022, particularly as European gas stores had not properly recovered from the high demands of the latter part of 2021. As of the final week of March 2022, gas price has returned around 230p/th. A higher proportion of renewable generation helped to mitigate the electricity market.

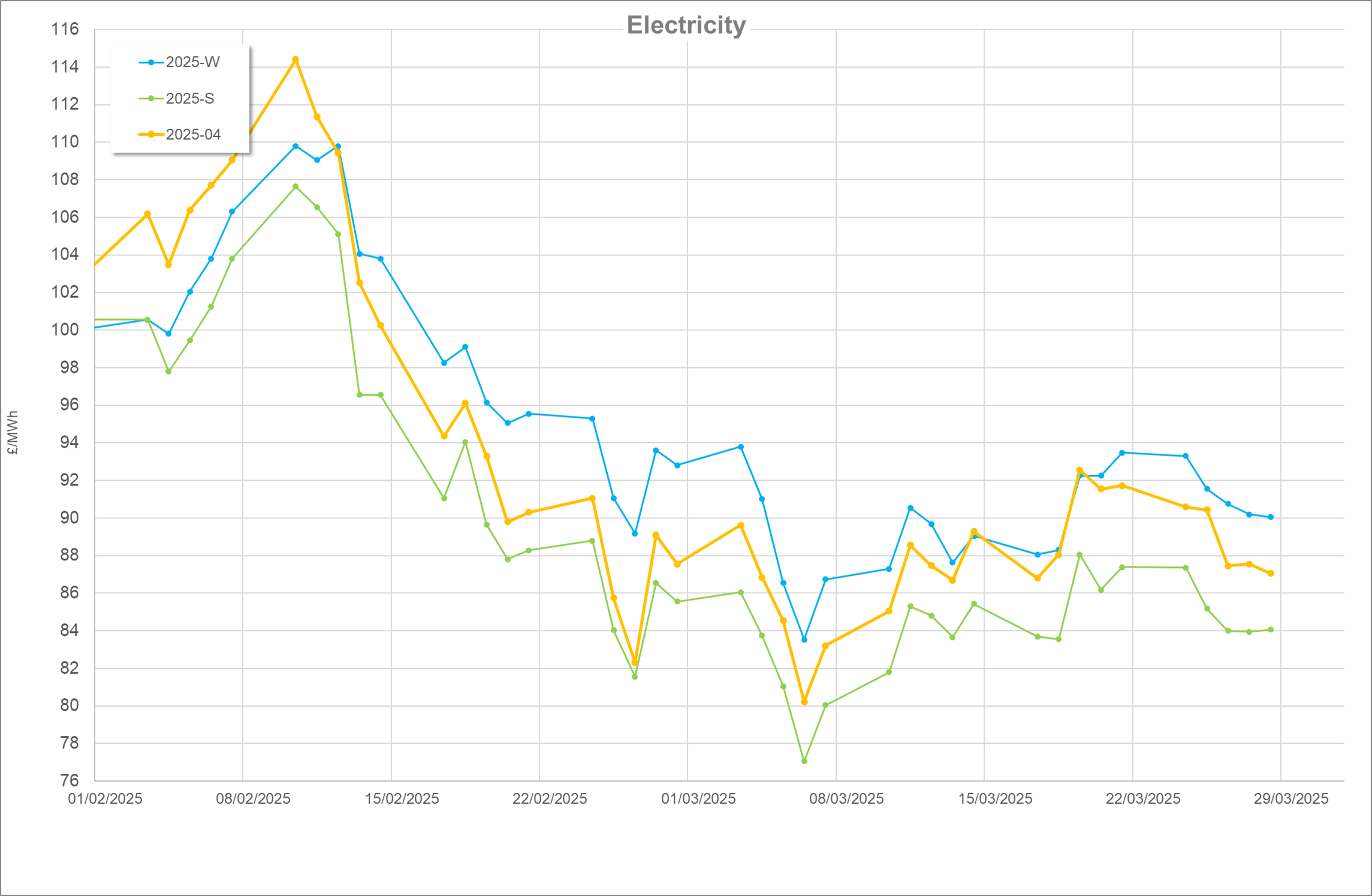

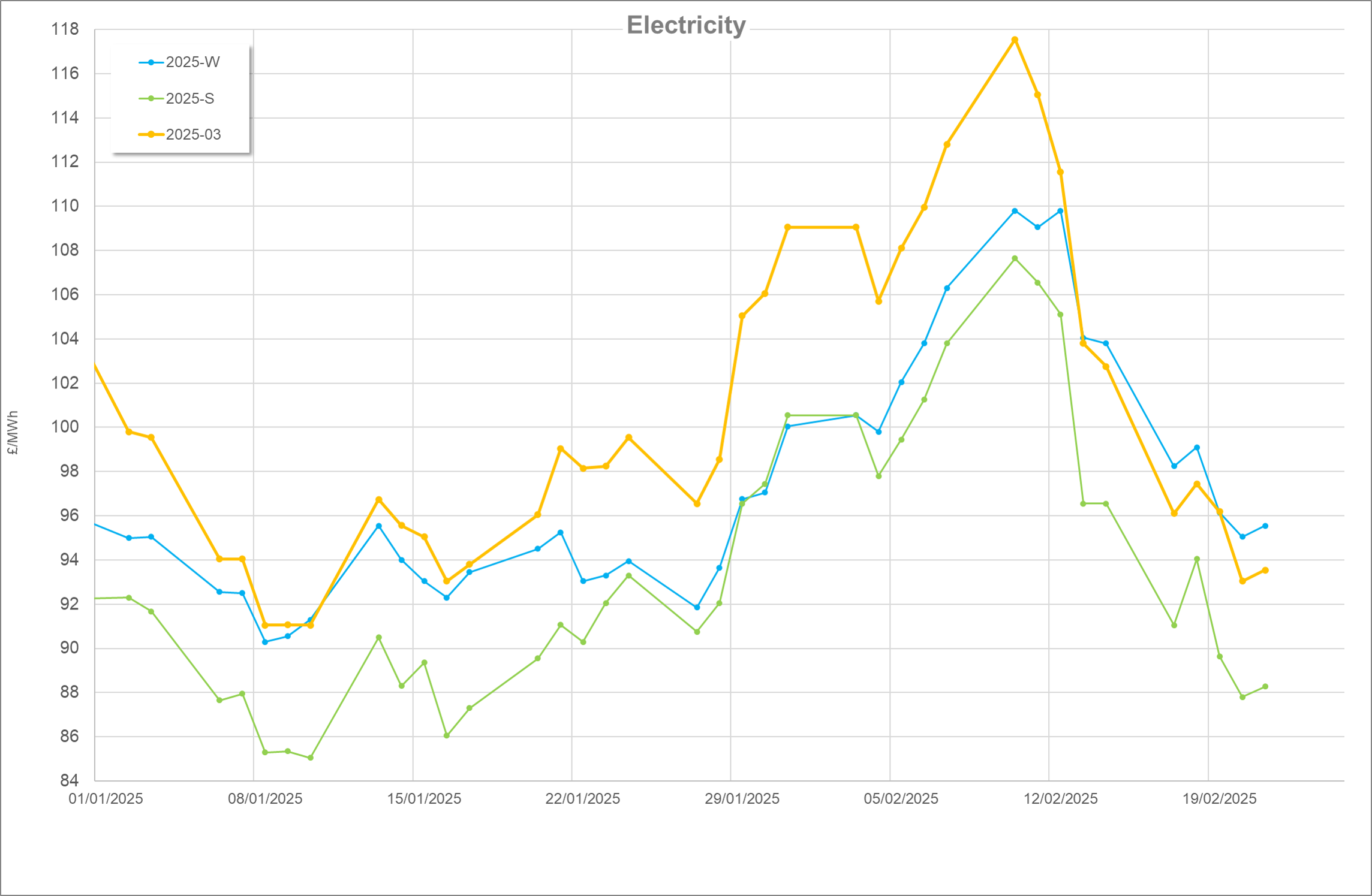

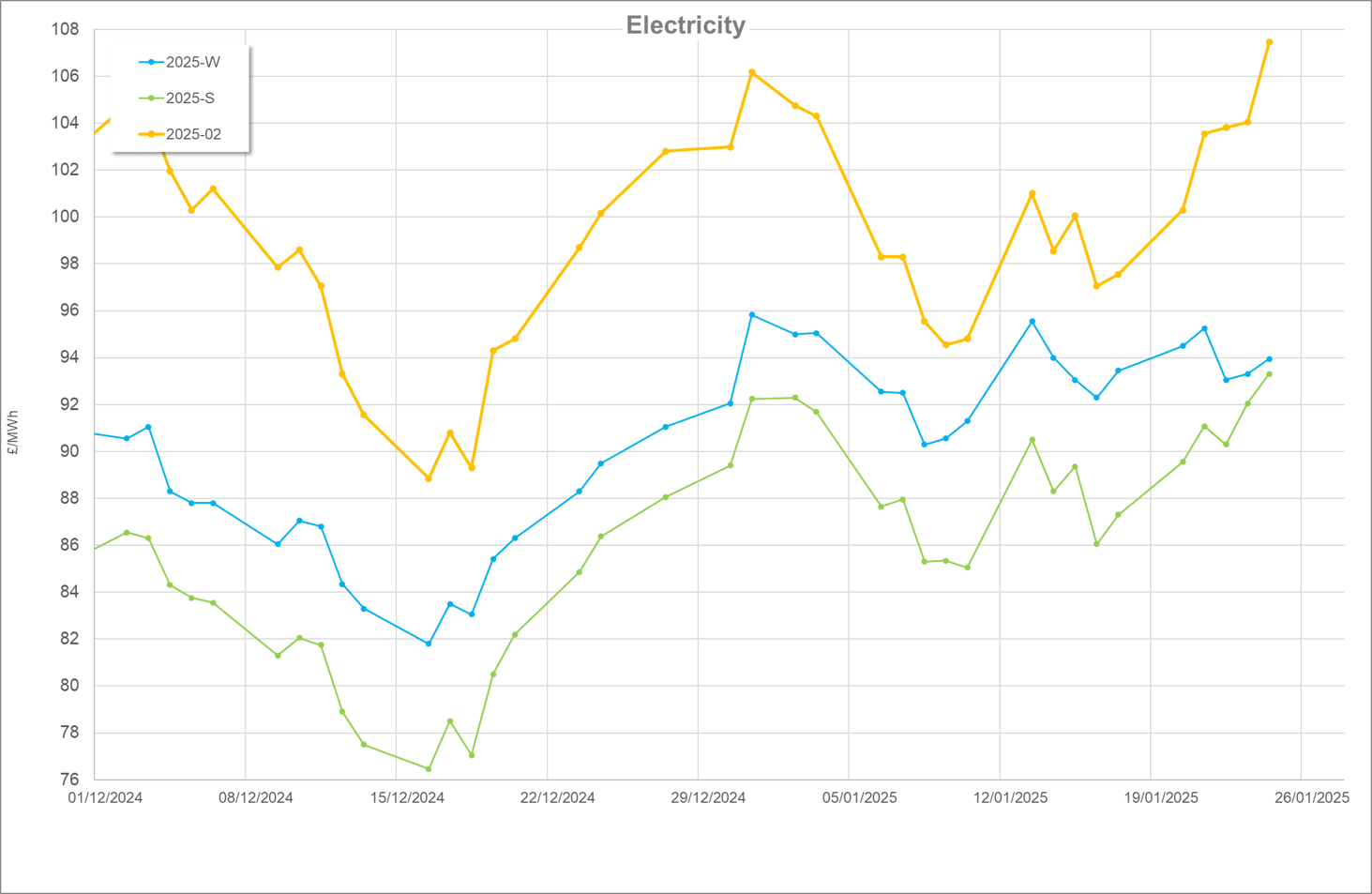

Figure 1 shows the monthly average prices for each of the energy markets discussed, from January 2021 to March 2022.

Figure 1 (Sources: Elexon, NordPool, & Marex Spectron)