Electricity cost changes

In April 2023 Transmission Network Use of System (TNUoS) was introduced for electricity users and generators. Its purpose is to raise funds to invest back into grid electricity infrastructure, and its mechanism is to increase the cost per connection point based on kVA capacity banding, rather than increase the cost per kWh used or time-of-day charges (e.g., red/green band). Now, TNUoS rates are up for review, and they are forecasted to increase.

Traditionally, horticultural sites with Combined Heat and Power (CHP) have favoured slightly oversized electricity import connections, which are only used during CHP downtime. However, it may be worth reducing the available connection capacity better to minimise the new capacity charges. The risk being that if CHP becomes uneconomical to operate and a site becomes entirely reliant on grid power, a reduced capacity may not be sufficient for site operations.

Future gas cost changes

There are two routes that gas costs may take in the future, either an increased capacity cost, or an increased commodity-based cost. Put simply, an increase in capacity cost will likely promote increased CHP operation – minimising the impact by spreading the fixed cost over more CHP run hours.

Commodity-based costs are seen on electricity bills now, in the form of renewable levies (FiT, ROC, CfD). Arguments have been raised against the charges being levied on electricity import, particularly by heat pump operators who use electricity to produce ‘low carbon’ heating and see the charges as a ‘carbon tax’ which they should be exempt from.

Rather than migrating any of these charges onto gas, as they support electricity generation schemes which make sense to be funded by the end use of that power, the more likely outcome is that charges which help fund gas replacement schemes such as the (Green Gas Certification Scheme) GGCS and future hydrogen production incentives are introduced. Alternatively, a plain ‘carbon tax’ could be added and diverted into future decarbonisation funding schemes.

This change would clearly make the spark spread of CHP operation worse and potentially reduce operational hours.

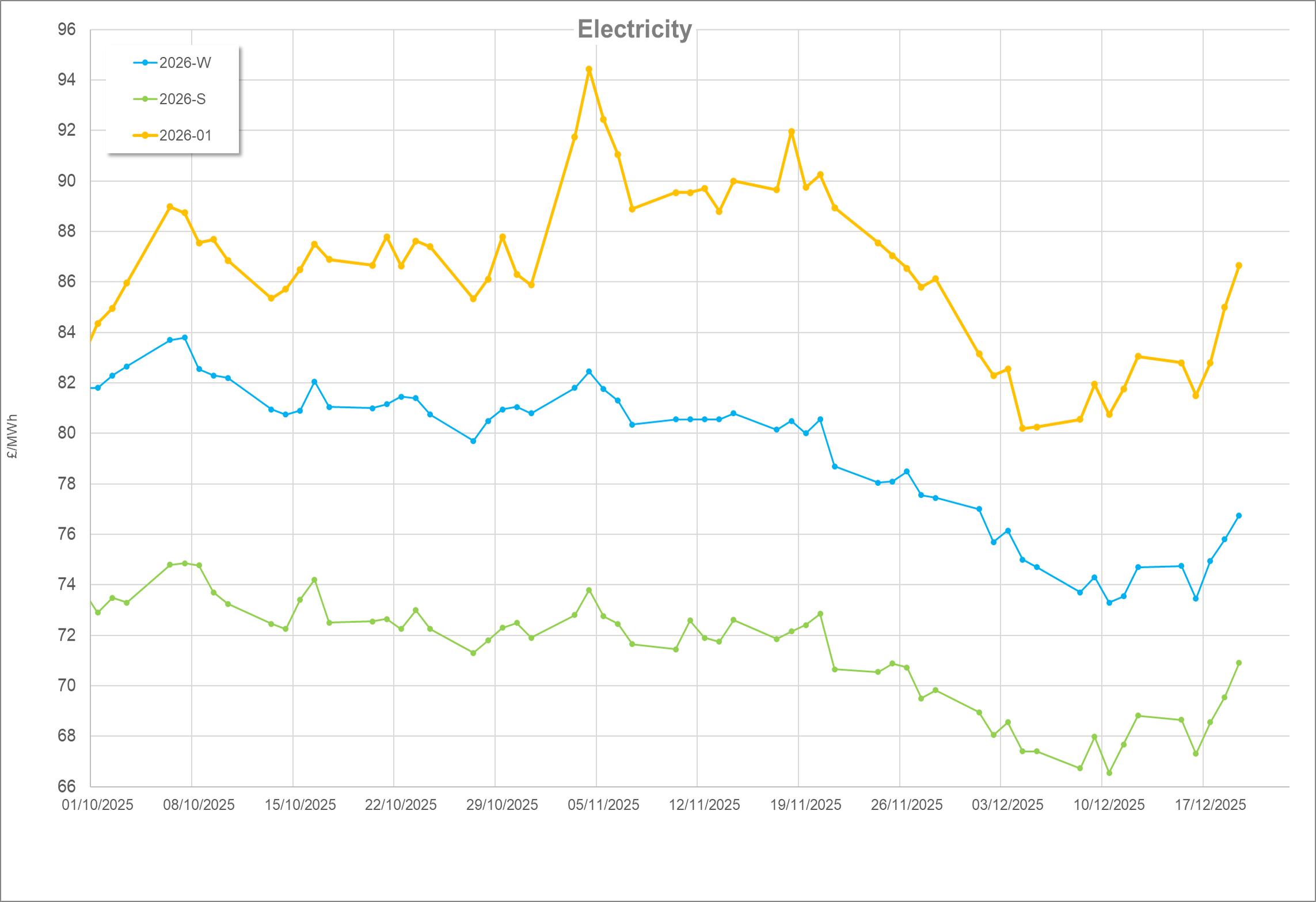

Spark spread

Long-term gas prices range between 60-80p/th (commodity only). Assuming typical electrical efficiency of 42%, this means the cost to generate electricity from a CHP is between 4.9-6.5p/kWh. Long-term electricity prices range between 5.6-7.2p/kWh (commodity only).

Very simplistically (ignoring financing, maintenance, contract management, and the value of heat and CO2, etc.) this leaves a spread of around 0.7p/kWh. Therefore, gas prices only need to increase by 0.4p/kWh (10p/th) before the spread disappears altogether.

Although already important now, the best case for future CHP operation will be maximising the use of all outputs from the engine: electricity, heat, and CO2.

For more information on energy contracts, trading, or CHP operation, get in touch with NFU Energy.

Written Eirinn Rusbridge