The government announced the Climate Change Levy (CCL) scheme will be extended until March 2027. The scheme has now reopened to new entrants allowing businesses that have not signed up to save up to 92% on CCL tax, if they carry out one of the many eligible processes – which includes Protected Horticulture.

Businesses that sign Climate Change Agreements receive a discount on CCL charged on energy bills in return for meeting energy efficiency targets. Millions of pounds have been saved on CCL since the introduction of the scheme in 2001.

Climate Change Agreements were first established in the early 2000s after the introduction of the Climate Change Levy tax. Their purpose is to encourage greater uptake of energy efficiency measures among companies in energy-intensive industries to relieve competitive distortion brought about by an additional tax on UK industry. They set energy reduction targets for businesses which can result in a significant discount on the Climate Change Levy (CCL) tax levied on energy bills.

CCL is a tax levied on import of Gas, Electricity, LPG (liquefied petroleum gas) and other solid fuels which most businesses will see on their energy invoices or delivery notes and can account for a big part of their utility bill. The NFU Energy CCL scheme enables operators in three sectors to get a discount where they use energy in the defined eligible processes for that sector, which can be summarised as:

- Pigs – the rearing of pigs indoors for meat.

- Poultry – the rearing of poultry for eggs or meat.

- Horticulture – the growing crops within a protected environment such as a greenhouse.

There are many more sectors eligible to apply for a CCA which may apply to you and your operation. More information on these can be found here: CCA sector contact list.

Why join?

- CCL rates levied on commodities have slowly increased over the years, so signing up to a CCA can really improve your bottom line.

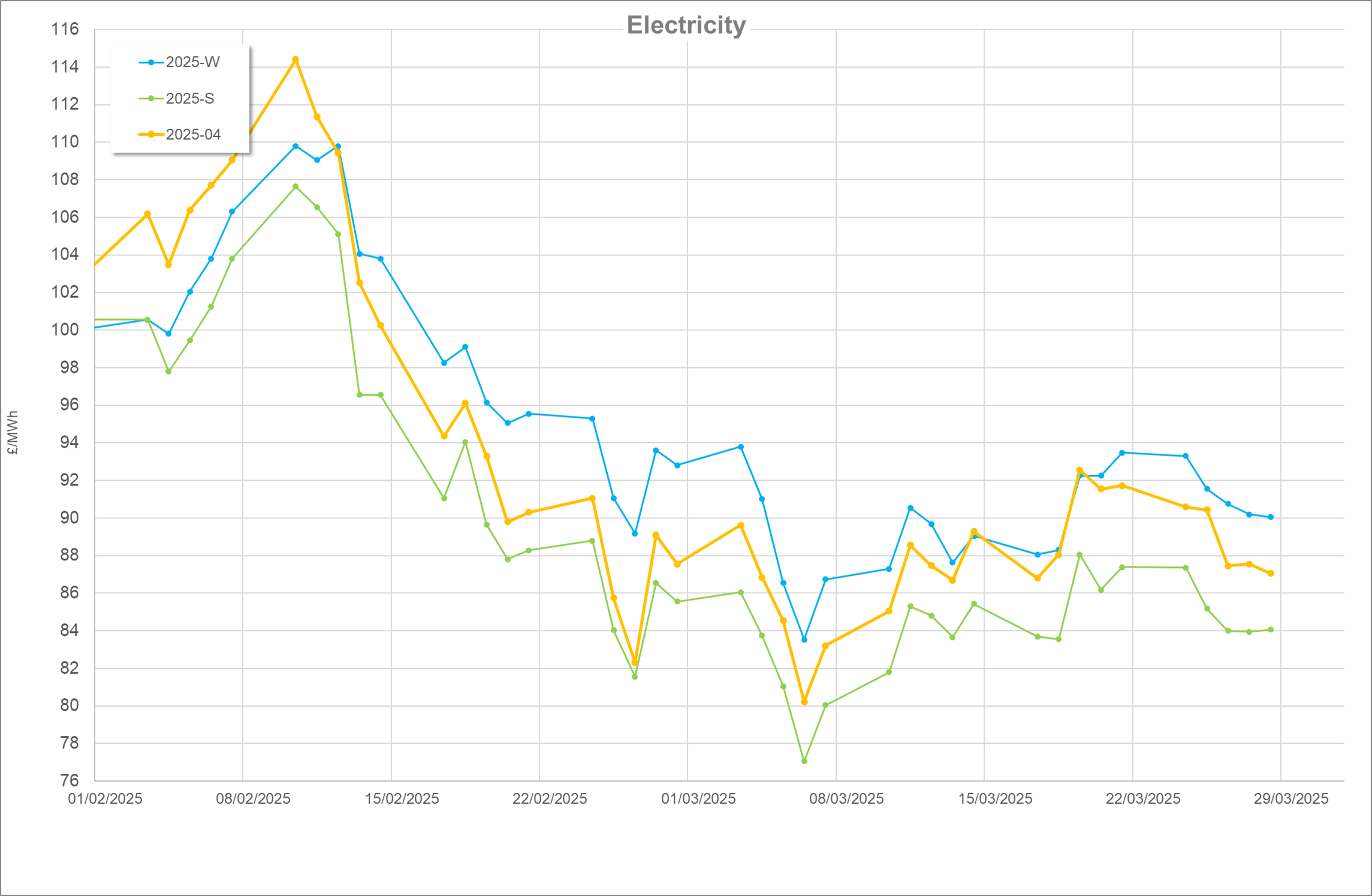

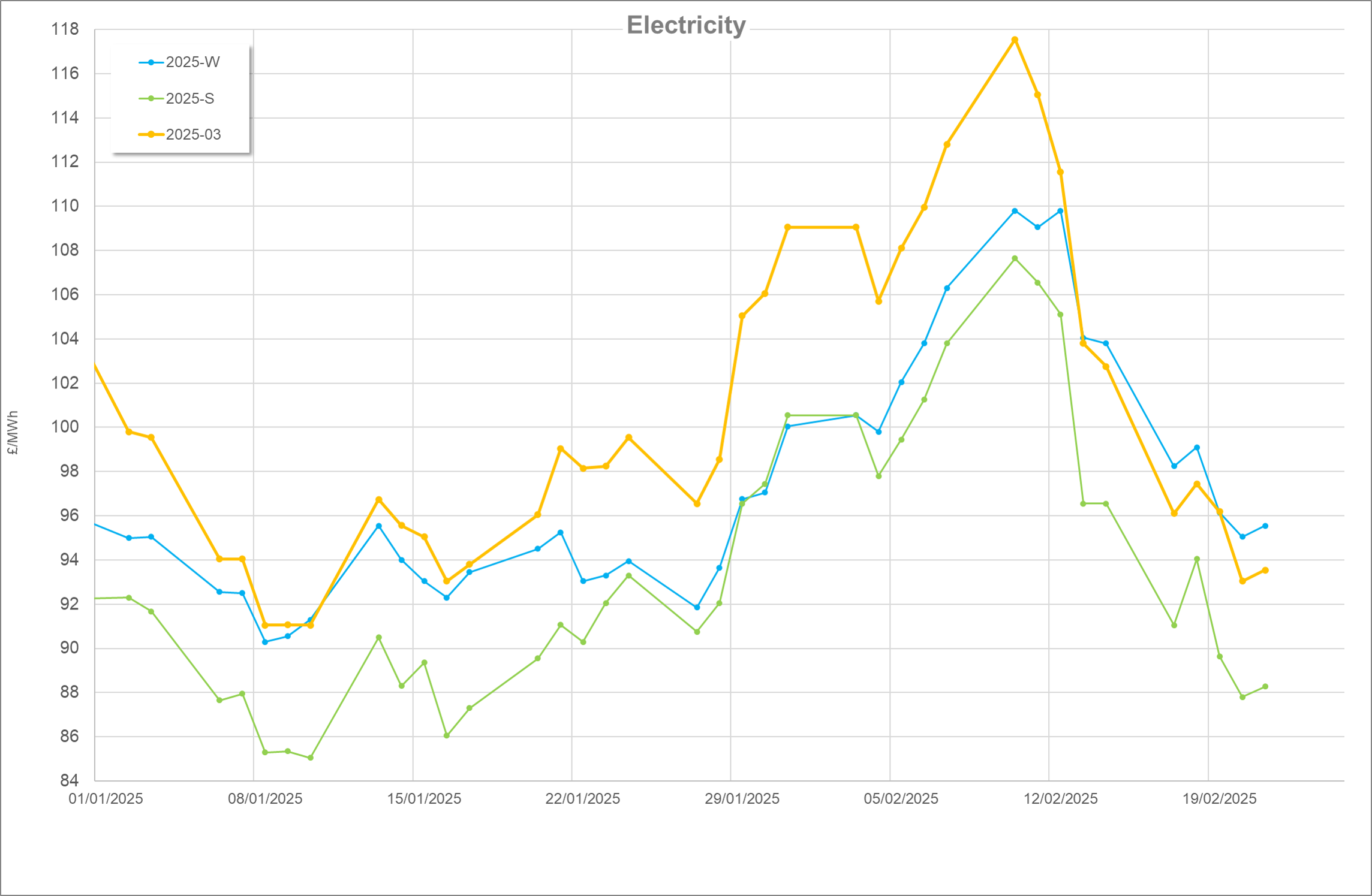

- Electricity CCL rate is 0.775 pence/kWh.

- Natural Gas CCL rate is 0.672 pence/kWh.

- LPG CCL rate is 1.0875 pence/litre.

- If the agreed reduction targets are met, currently the participants can claim:

- 92% relief on electricity

- 88% on Natural Gas and other solid fuels

- 77% on LPG

- It’s an opportunity to demonstrate to your suppliers that you are committed to improving the environment and energy sustainability of your business.

- Achieving your targets or deciding to pay a buy-out fee to meet any shortfall in achieving them, will enable receipt of a discount until March 2027.

By way of an example, a 5Ha high temperature edibles grower could benefit financially by between £150,000 and £250,000 per annum where gas boilers are used for heating either with or without supplementary lighting.

What does it involve?

If you are interested in joining then you should speak to the team at NFU Energy who will explain the requirements, discuss the pros and cons and have helped many growers navigate the application paperwork. The following information is given as a guide to what’s involved.

Alongside carrying out an eligible process mentioned above, the following criteria must be met too:

- 70% or more of total site energy is used on the eligible process listed above.

- Adequate data and metering are in place to accurately record energy usage.

Once the eligibility application has been approved, attention is then turned to setting the base year for future reduction targets to be evaluated. The base year is a 12-month period that shows the amount of energy used on site and the amount of product produced. With this information, a Specific Energy Consumption (SEC) can be calculated to show how much energy was being used per product metric. The Environment Agency (EA) will then set a percentage reduction target for the participant to meet every two years. This is known as a Target Period.

At the end of a Target Period, participants are asked to provide their energy and production data which will then be sent to the EA. They will evaluate whether a business has become more energy efficient by reviewing the SEC and check whether it has been reduced by the percentage target that was agreed..

Meeting the target certifies your business to continue claiming CCL relief for another two years until the process is repeated. However, not meeting your target reduction will result in a buyout determined by the amount of energy you have exceeded the target by. The energy is then converted into tonnes of carbon and a set fee per tonne of carbon is payable, currently at £18 per tonne.

The CCL scheme will be open to new entrants until 30th September 2023. Ensure you get your application submitted in good time before the end of August 2023 to allow time for verification and approval. NFU Energy can help you with this. Submissions after August 2023 may not be accepted.

Authored by Steve Leil.