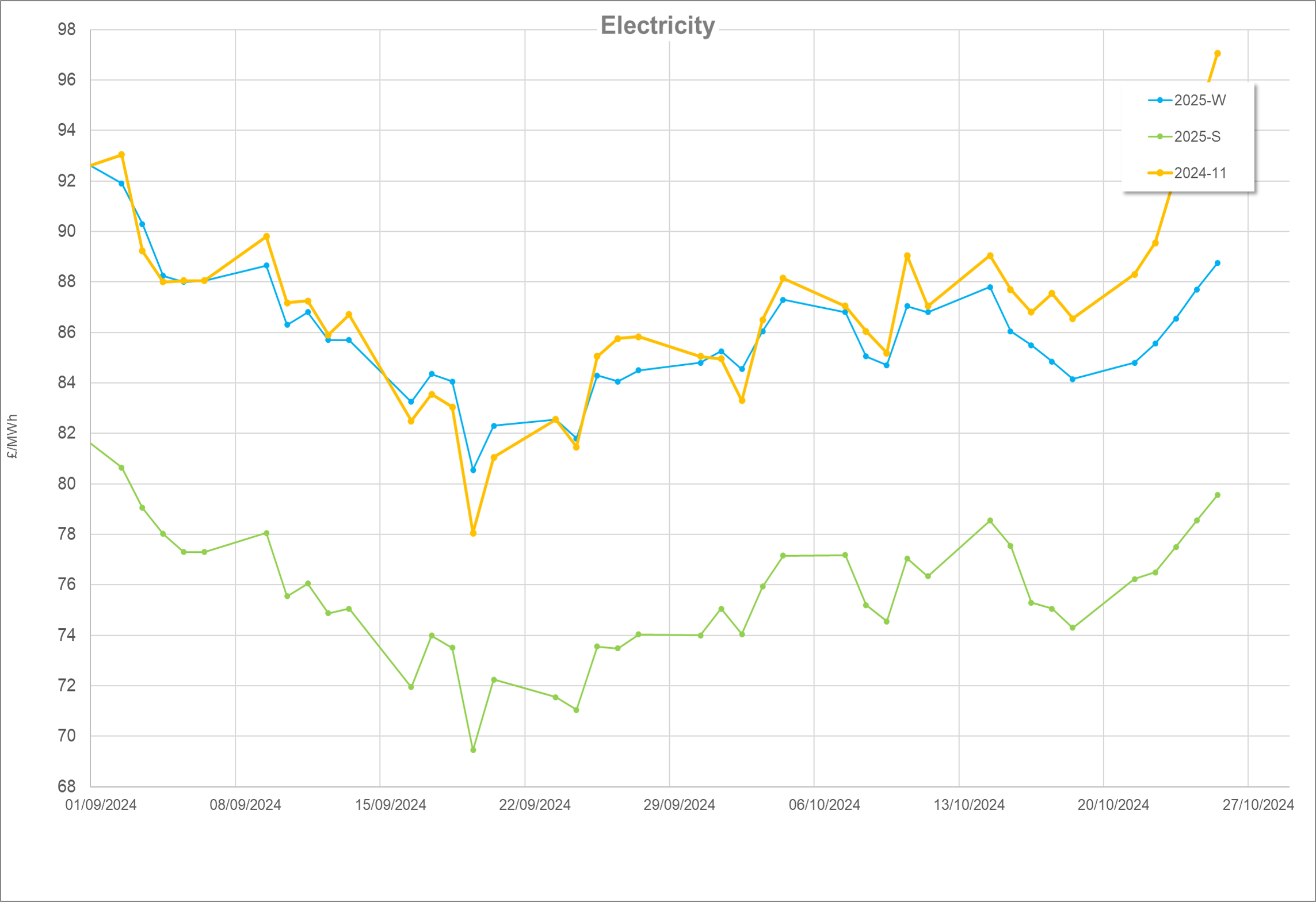

November Recap

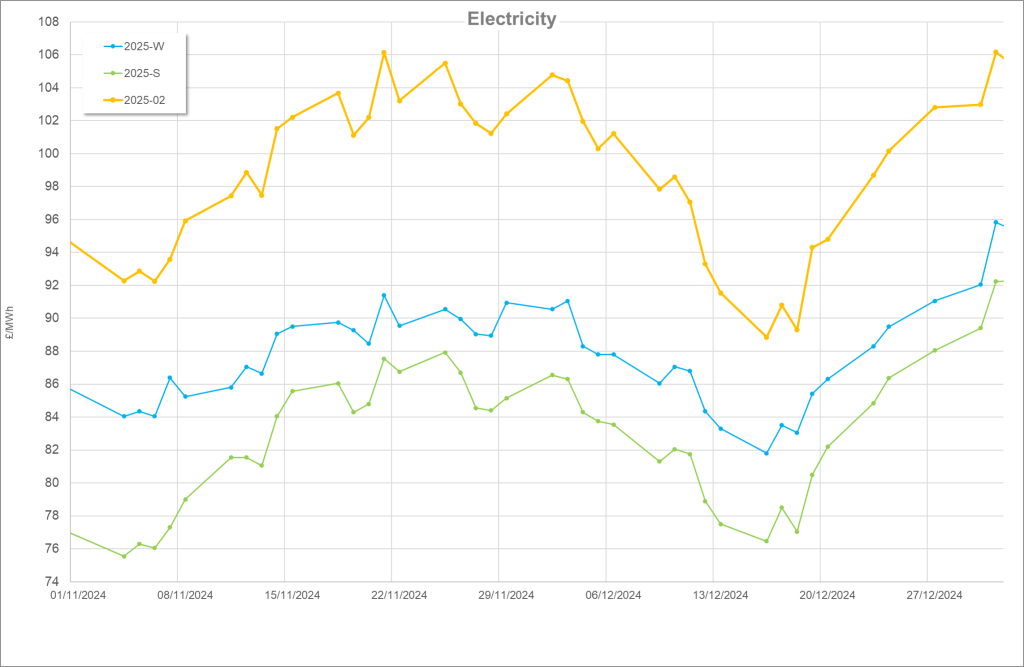

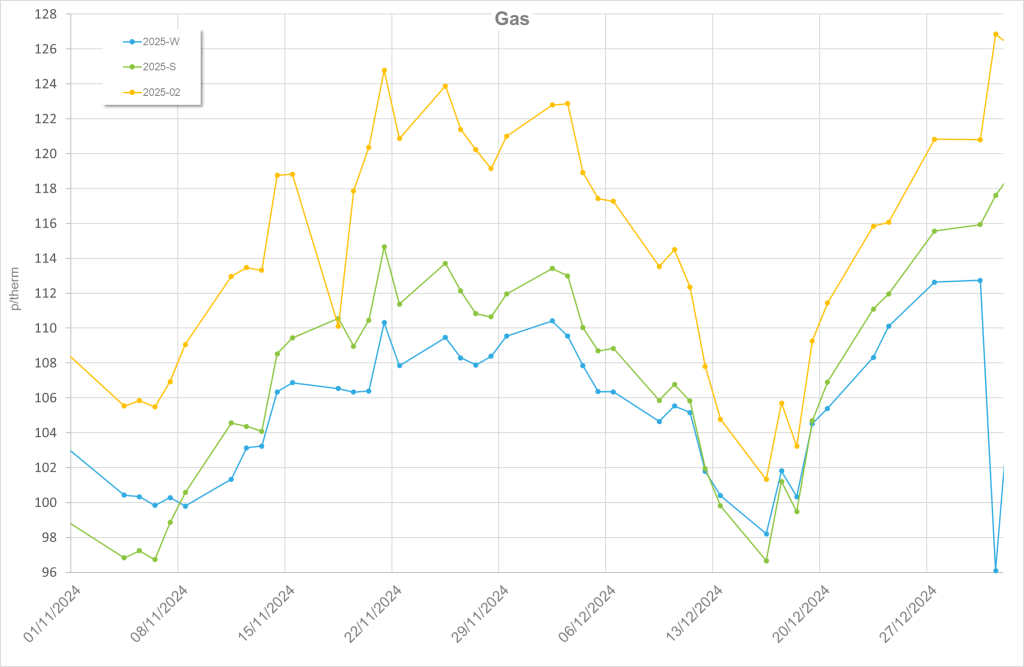

As Winter 24 got into full swing, prices increased steadily while the temperatures slowly dropped. Month ahead gas prices increased by 16% from month start to month end. Power followed a similar, although slightly less volatile, pattern as it increased by 10.5%. The UK had paid close attention to its gas storage stocks during the summer and despite some back and forward through October, entered November ahead of last year’s strong position. This came in handy during the month, as wind generation started and ended the month poorly. Gas took over in the generation stakes, leading 38% to 27% from our wind turbines.

Although we don’t talk much about solar in November, what capacity we would have had was also slashed by 85%. The combination of low wind generation and cloud cover causing low solar generation taught us the meaning of “Dunkelflaute” which, as we shift towards more renewable energy in the UK, will be one of our biggest threats. In combination with this, there was also a slight dip in nuclear power generation towards the end of the month which exacerbated price increases.

The markets also started to get nervous about the imminent cessation of the remaining Russian gas into Europe with a supposed deal with Azerbaijan set to replace it, however this did not materialise. Russian gas was in the news aplenty during November with Russian-owned Gazprom also on the wrong end of an arbitration case with Austria’s OMV which led to Gazprom needing to pay out approximately £190 million. This led to Russia halting supplies into Austria. A Russian counter-offensive in the Kursk region unsettled the markets, although it seems Ukraine continue to hold the region that contains the important Sudzha metering station. Contravening an EU mandate for no member states to import Russian LNG, Germany had accepted a shipment of the gas before a senior minister blocked the move at the last minute.

Donald Trump’s victory in the US election brought good news for UK’s energy security policy regarding LNG imports as selling the fossil fuel to the UK and EU is a key policy of his. LNG imports throughout November were strong, particularly from our American cousins. There was some continued back and forth in the early parts of the month regarding Israel and Iran’s second wave of “tit for tat” missile attacks, thankfully this stayed out of the energy market news for the majority of the month.

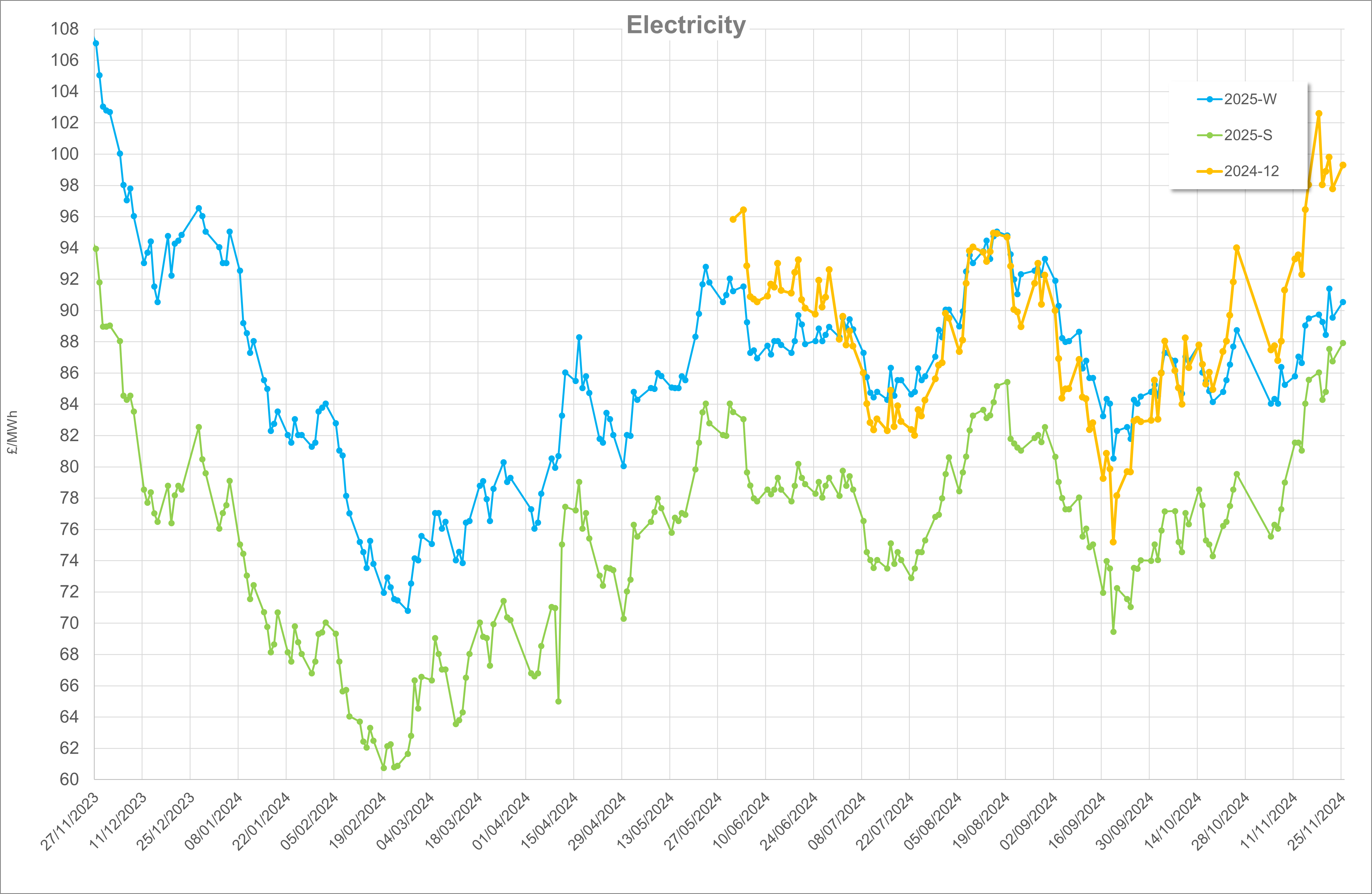

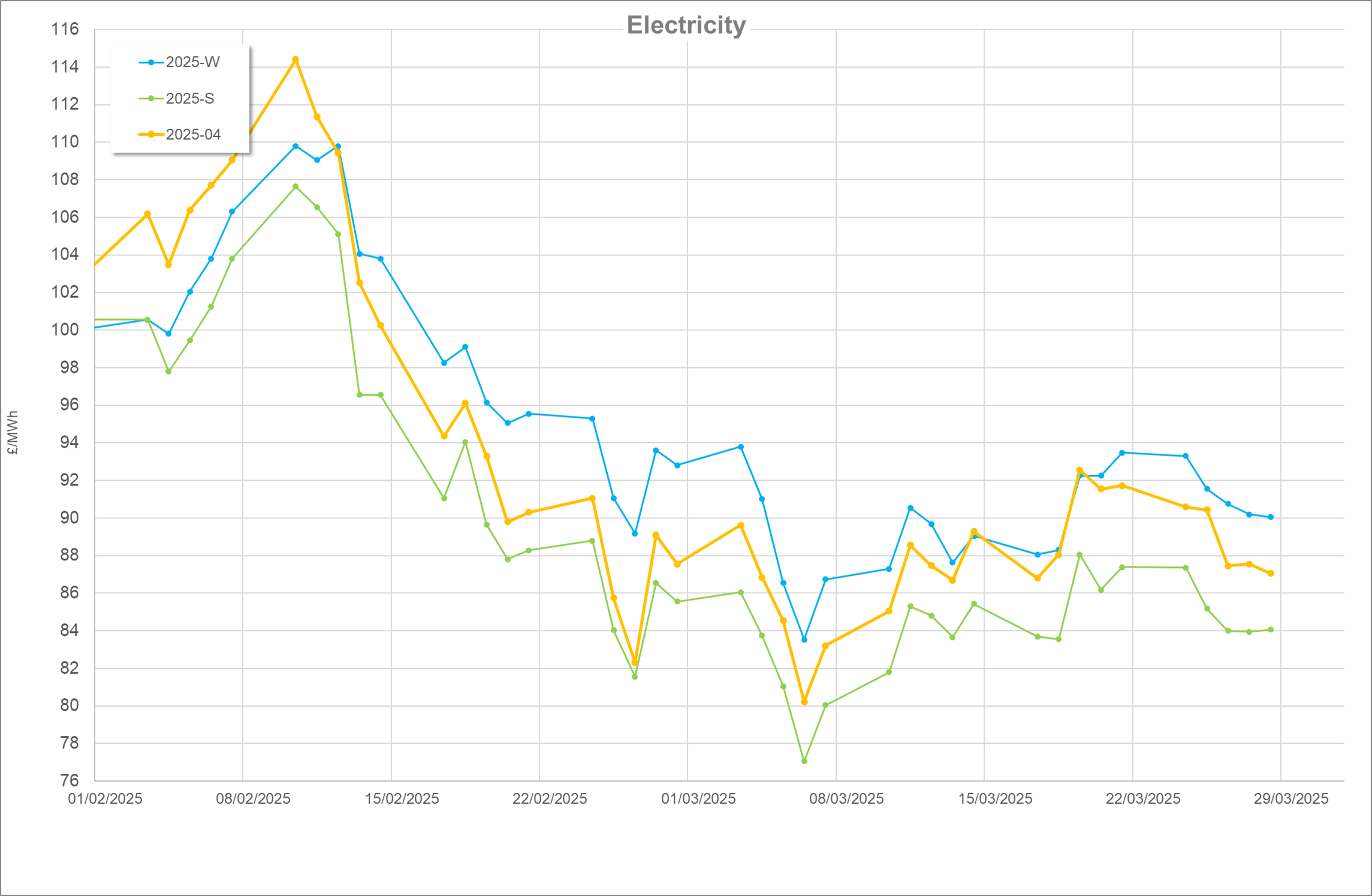

December Recap

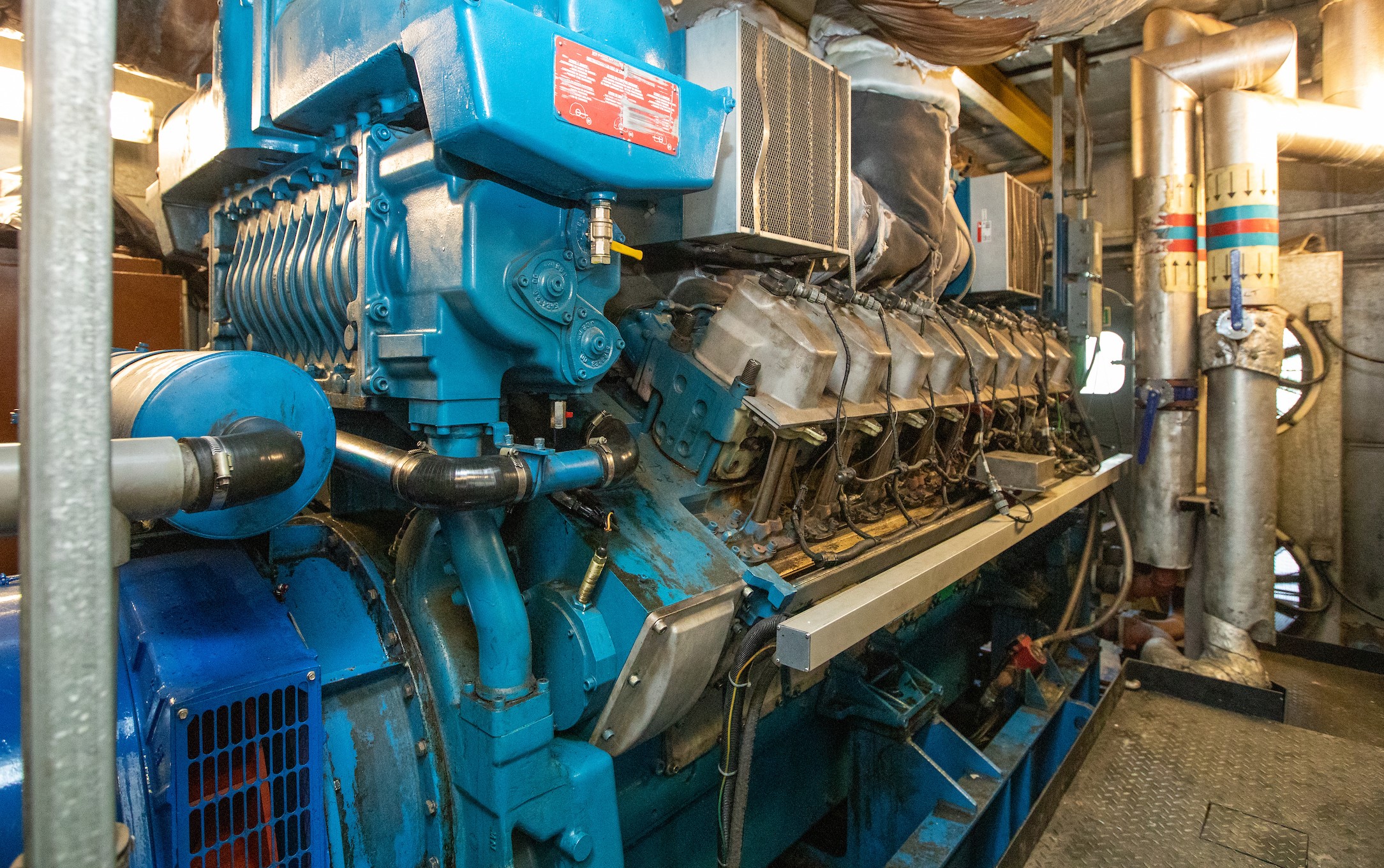

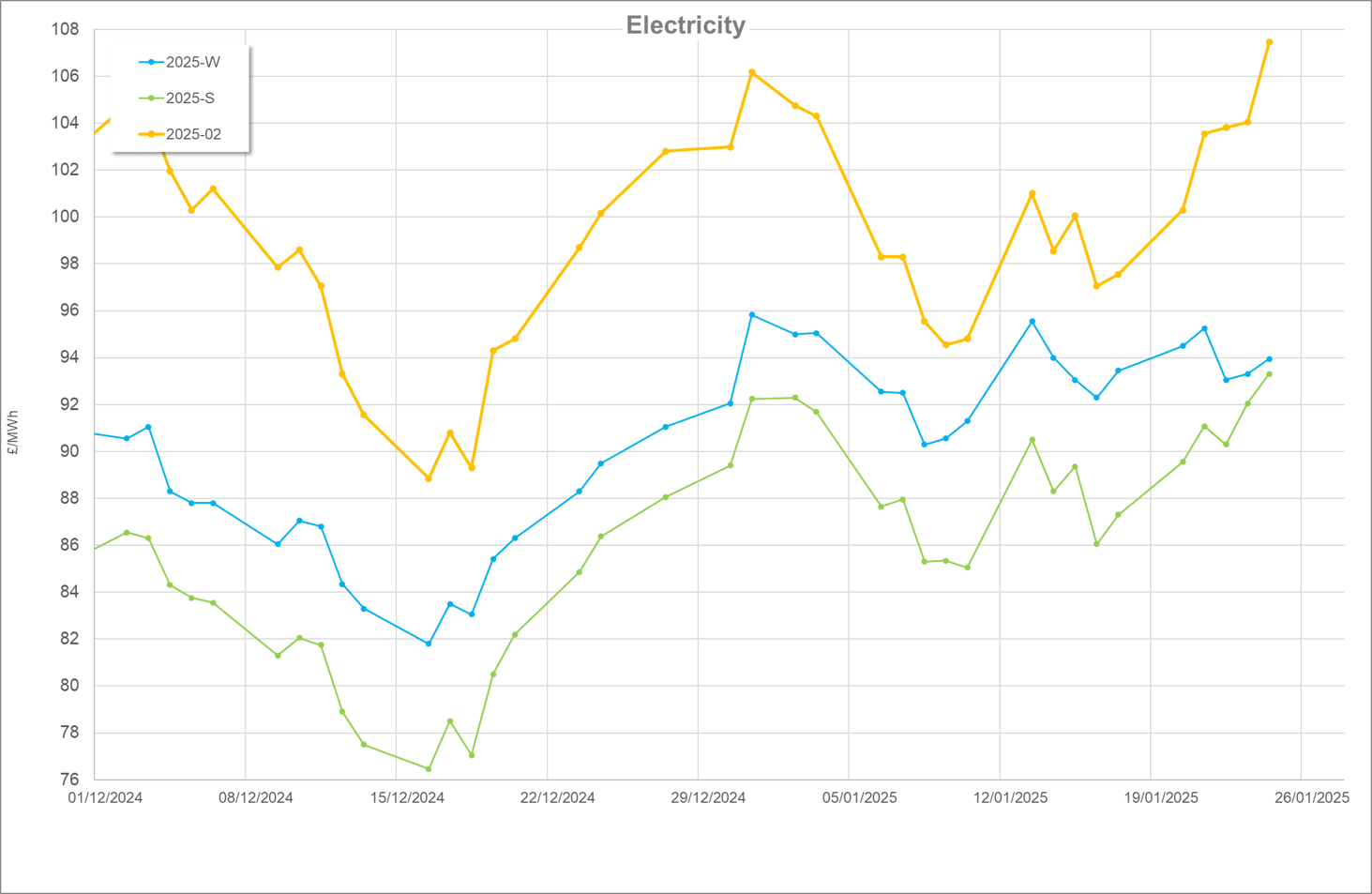

For natural gas CHP generators in particular, Mid-December saw a bit of a ‘unicorn’ in terms of conditions with gas prices tumbling and export power on the N2EX spiking to just shy of £500/MWh. Although this was short-lived, the brief window while it lasted was a relief from the generally poor spread through Summer 24 to present. Temperatures ebbed and flowed but the cold conditions saw gas demand rise. It didn’t surpass the seasonal average however which undoubtably helped influence price reductions.

In the wake of Donald Trump’s election victory, LNG from the new Plaquemines and Corpus Christi installations began to make their way to the EU while Freeport’s deliveries to the UK were plenty. On the topic of LNG, the Asian market’s demand was relatively low with high prices and solid storage levels reducing the need. Closer to home in the UK, storage was called on heavily during the month, closing around 7TWh below the 2023 position. Temperatures were largely below last year’s mild conditions in December. Injection into storage was consistent from 15/12/23 into the New Year, at time of writing we have yet to consistently inject into storage in December/Early Jan. Thanks to solid injections through the Summer however, levels ended the month around 60% full.

Despite some further Dunkelflaute on the 12/12 and 13/12, wind conditions were generally good during the month. Storm Darragh in the early parts of the month and consistently windy conditions mid-month helped ease prices. 27/12 and 28/12 saw wind production take a big dip, however it came during a period of low power demand. Nuclear generation climbed throughout the month as did imports, particularly from France who boasted that 2024 was their highest year of exports to date. EDF also announced that the Flammenville 3 reactor commenced production, marking the first new nuclear reactor in France in 25 years. Despite some small unplanned outages in the Norwegian gas fleet, levels were generally strong.

Notwithstanding relatively good fundamentals, the markets did not react too well to the halting of Russian flow into Europe that ended on the 31/12/24. Despite months of this pending, the EU stated that they were comfortable that this was “Expected and Prepared for”, pointing towards LNG, particularly from the US, as an example replacement strategy. This was backdropped by the Slovakian Prime Minister unsuccessfully trying to conjure a deal with Russia right up until the close of the year. Although there was talk in November of a Azerbaijan deal with Slovakia to replace Russian gas that ultimately fell through, renewed talks emerged and a pilot was conducted which was encouraging for the future. In a curious case of timing, an Azerbaijan Airways passenger jet crashed in Kazakhstan after diverting out of Russian airspace. Reports have suggested that the Embraer Jet was hit by Russian anti-aircraft fire which has been active in the region to combat Ukrainian drones. Although Putin apologised to the Azerbaijan Prime Minister, he did not overtly accept Russian responsibility.

A failure in the BritNed interconnector that links the UK and Netherlands provided a knock to energy security, especially after it was announced that the outage would extend into the new year. There was also an extension to an outage at the UK and French Eleclink interconnector into February. While on the topic of interconnector, in another wave of déjà vu, the EstLink-2 cable between Estonia and Finland was severed in currently unknown circumstances exacerbated by taking place on Christmas Day. This is eerily similar to the severing of the Baltic Interconnector last year by a Chinese cargo ship that caused prices to increase.

This update was written by Edward Kimberley