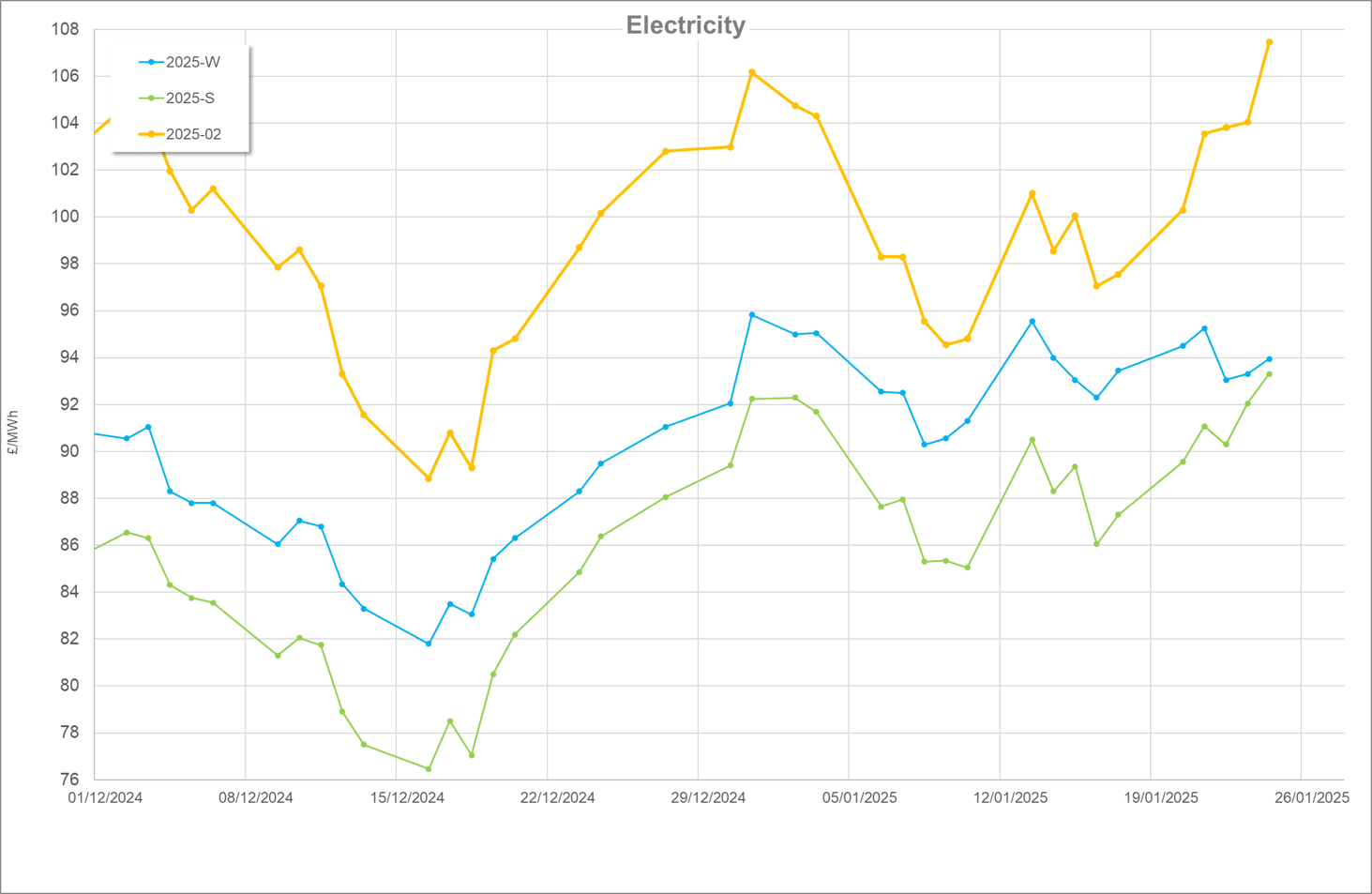

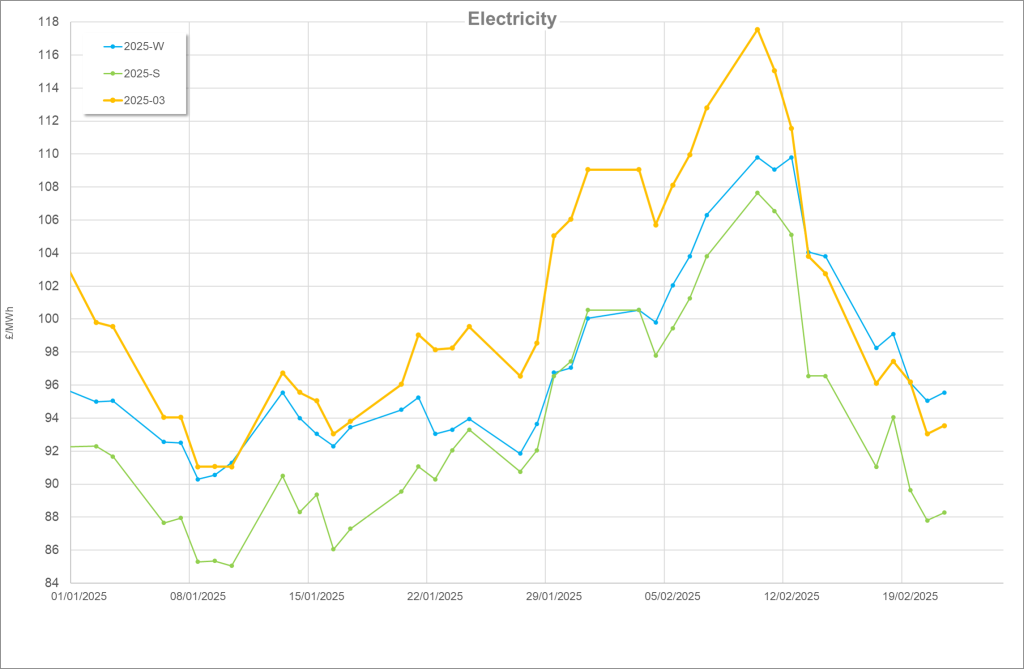

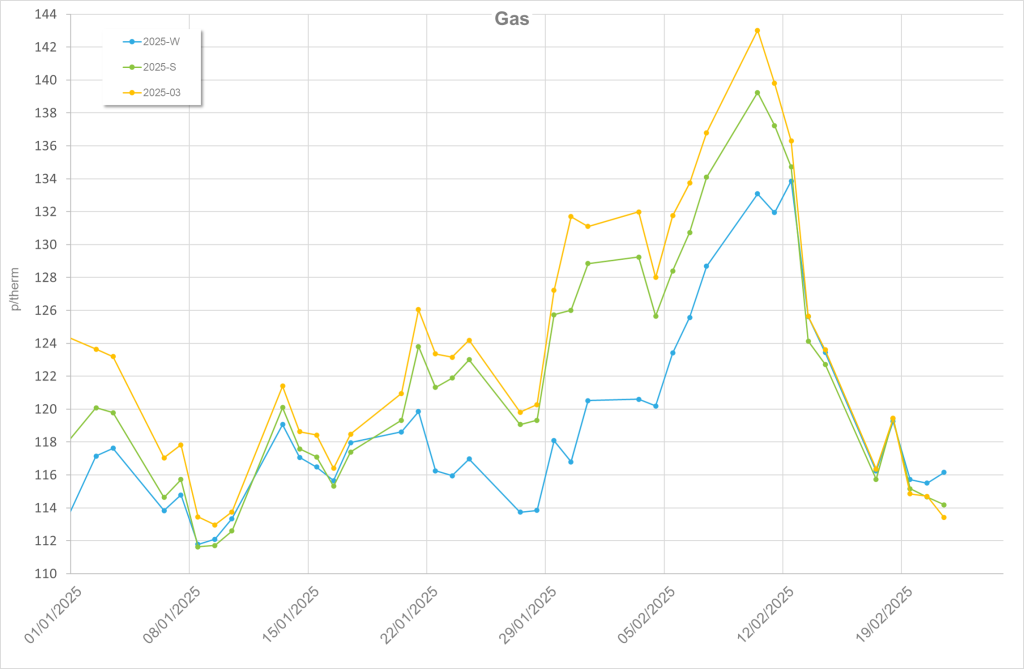

January Recap

After a turbulent December in the markets following the wake of the exit of the last remnants of Russian gas into Europe, early January saw these prices continue to decline, before prices rapidly increased towards month end. It seemed that for the most part this was caused by another major concern with gas, as European wide storage stocks plummeted with apparent little incentive to inject.

Although the month start and end saw some good renewables output, Gas won the month’s generation race beating Wind by 10%. The inauguration of Donald Trump also somewhat surprisingly contributed to the price increases. Although Trumps policies of large scale LNG sales to the UK (and Europe) should help ease gas and power prices, the inverse was initially true potentially triggered by market sentiment after the new president submitted a swathe of decrees while his cabinet where heavily scrutinised in the news.

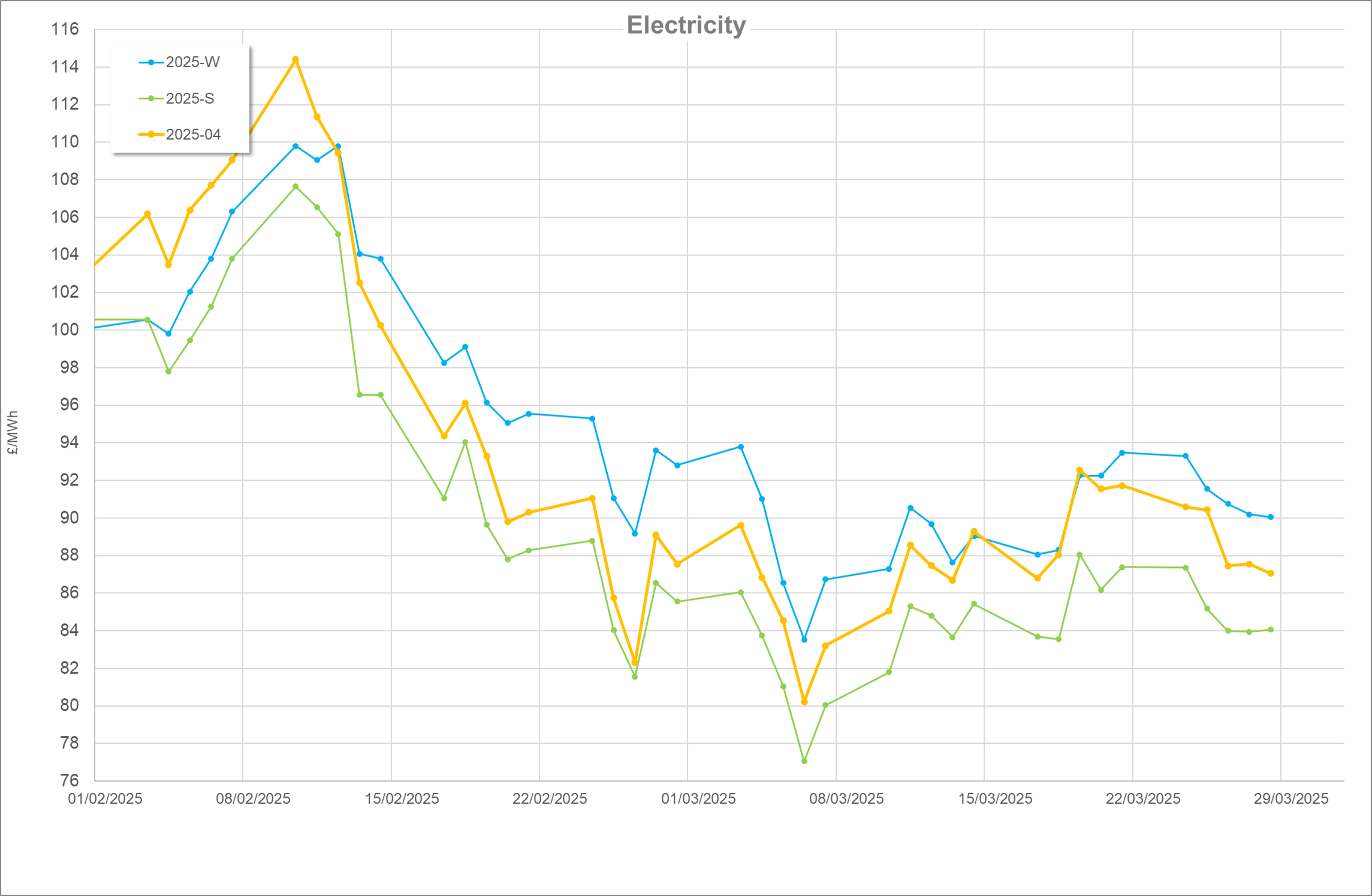

February

Some rather sharp price rises continued into February, however these sharply dropped away towards the middle of the month. Although gas storage was still a major concern throughout the month, with the lowest levels seen in the last 24 months, a milder weather front towards the month end allowed injections to occur. After several EU nations appealed to Regulators regarding the potential negative impact to storage should an additional price cap be introduced, subsequent talks seem to have calmed the markets although it is unclear at present what the outcomes of this will be. That said the EU is engaging in reforms which overall seem welcome.

Temperatures were a big concern to the markets throughout the month with long range forecasts suggesting temperatures would stay below-average into March. There was, however, a break in the cold conditions towards month end which dramatically eased prices. At the time of writing it is neck-and-neck between wind and gas for the main power generator, what is clear however is that the renewables have been a lot more consistent through the month which will have helped prices to reduce.

Another matter helping prices reduce was the restoration of the ElecLink interconnector between the UK and France after 4 months of downtime. As the French have been boasting ~50GW of output recently, it is good that more of this can flow through to the UK unabated.

Ukraine was very much in the news with peace talks opening between Donald Trump and Vladimir Putin, although it was somewhat curious that Volodymyr Zelenskyy was not invited to these talks thus complicating the outcome. Peace in Ukraine could, in theory, be succeeded by the return of Russian gas to Europe which should help reduce prices. However, Donald Trump’s LNG exports to Europe are poised to fill this gap which sets up a curious conundrum. Part of the prices breaking was also attributed to a large volume of LNG deliveries to the UK and wider Europe. Despite the backdrop of a potential end to fighting, Russian attacks on Ukraine’s energy infrastructure intensified throughout the month and increased exports to Ukraine were observed from its neighbouring nations.

Written by Ed Kimberley