December Recap

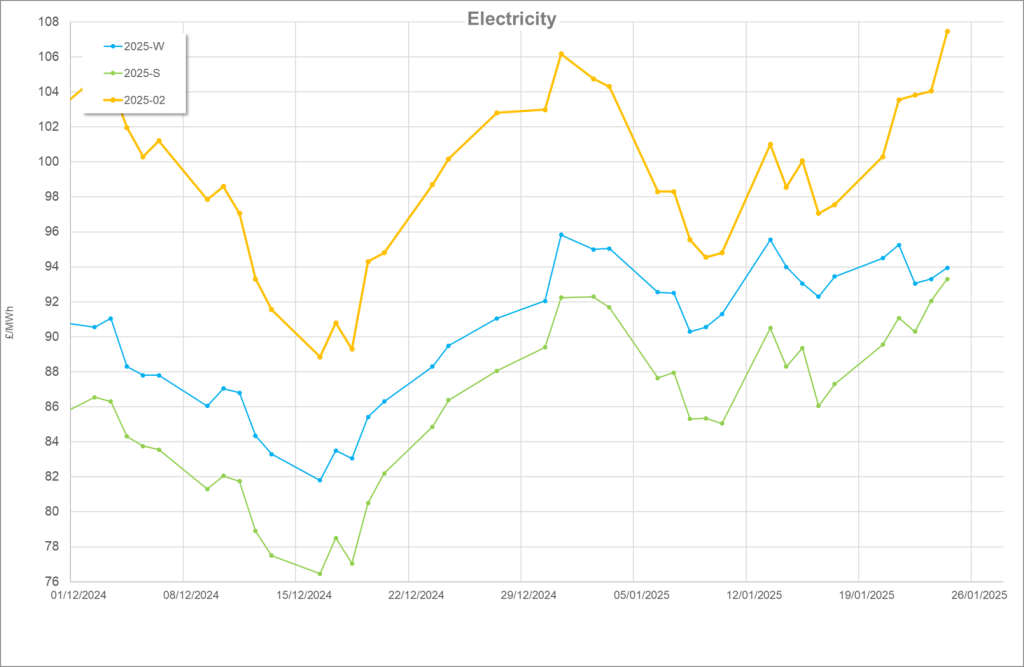

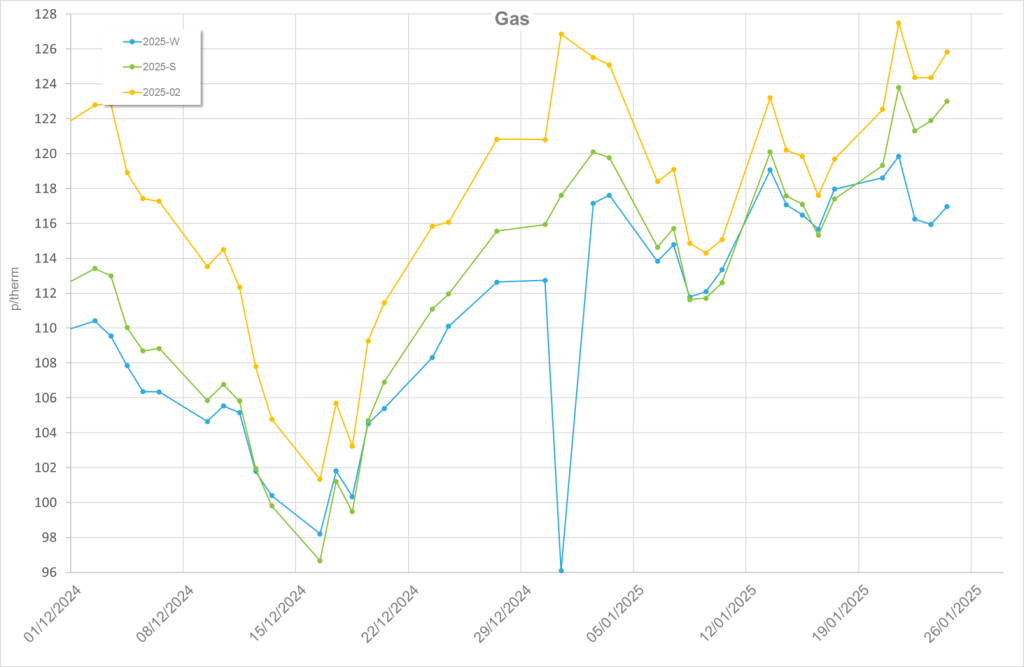

December was quite a turbulent month. With the last remnants of Russian gas exported to Europe ending on 31/12/24, the market’s reaction in the run up was less than calm. Although European Union rhetoric was that they were prepared for these contracts to run out, prices did not initially follow that sentiment. Neither, seemingly, did the Slovakian Prime Minister who tried to negotiate with Vladimir Putin right up until the final hours.

It was not just gas’s interconnection between Europe and Russia that was in the news, the power interconnection between the UK and Europe took a hit too. Both BritNed (link between UK and Netherlands) and ElecLink (between UK and France) were offline during the month. Although not directly linked to the UK, EstLink 2 between Finland and Estonia was damaged in a shockingly eery incident mirroring last year’s Baltic Interconnector incident. This time however, a Russian, not Chinese, cargo ship was deemed to be responsible.

Temperatures toward the middle and end of the month in particular chilled consistently below seasonal average. This saw gas consumption for heating increase to approximately normal demand, with some days exceeding this demand. This scenario was scarcely seen in the mild Winter 23 trading period that allowed the UK to easily manage to inject into storage. 12 months later, December 24 saw little gas injection and overall withdrawals leaving the UK ~6TWh below last year’s position on December 31st.

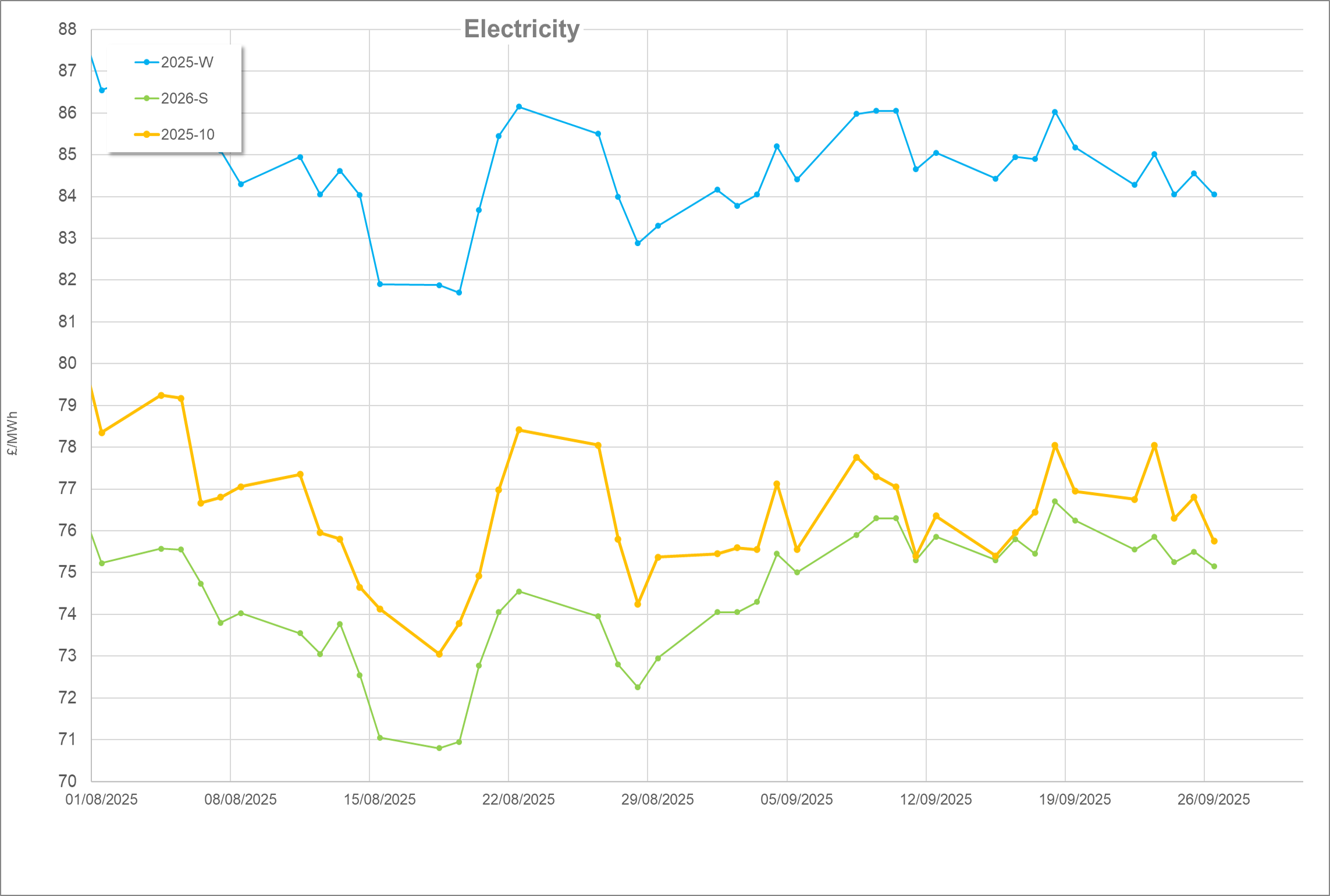

It was not all bad news despite what the prices might have led you to believe. After a summer of flat export prices, the N2EX started to flutter up particularly in the aforementioned periods of low wind output. Low wind was somewhat of a rarity, with 39% of UK power generated by our turbines vs the 29% generated by gas. Should wind have been poor, the price rises and storage stocks would have been considerably more bleak.

Although ElecLink was down, the French brought their first new nuclear reactor online in 25 years at Flammenville 3, which will undoubtably export to the UK through its lifetime. With Donald Trump’s inauguration looming in January, we saw Plaquemines and Corpus Christi begin to export LNG with the first shipments arriving in Germany. The anticipation of additional LNG source from the United States should see the UK as a regular customer, helping balance periods in the UK when gas demand spikes.

January

The end of 2024 marked an important first in the UK’s energy strategy as wind out-generated gas over the course of the year. 30% of our power came from wind with 26% coming from gas. Nuclear was 3rd at 14% with imports coming 4th at 12%. In imported power, it is worth noting that France increased its imports to the UK by 5% compared to 2023.

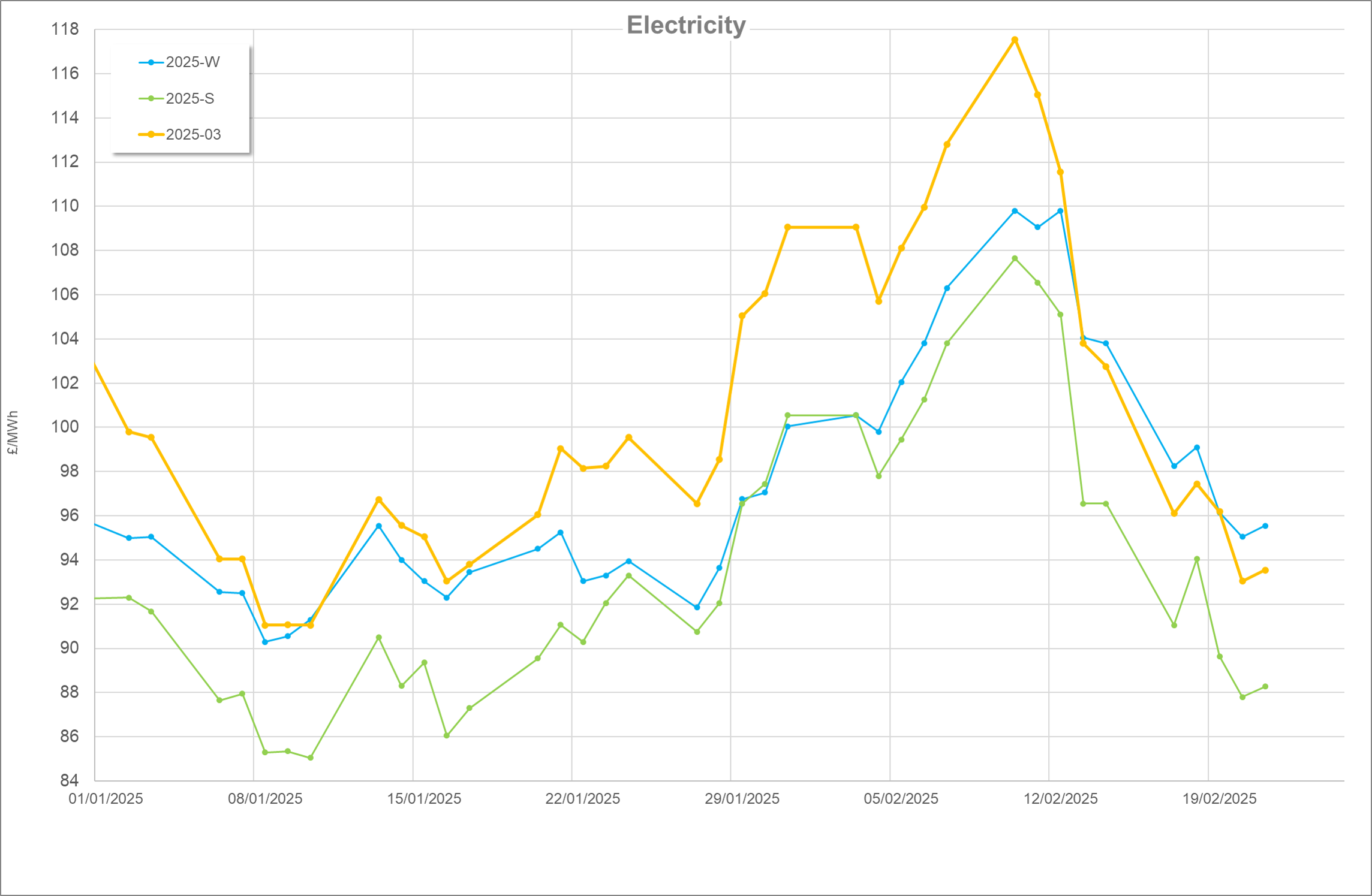

January’s wind production however slipped behind gas, despite our turbines enjoying a boost from Storm Eowyn. Lulls in wind also saw some attractive N2EX and imbalance pricing particularly on 8th, 10th and 20th-22nd January.

National Gas’s graph representing storage positions throughout January resembled a slide in a children’s playground, with withdrawals being steadily seen through the month before plateauing at month’s end. The position was around 8TWh below January 2024 as some slightly colder weather, mixed renewables, and more bullish consumer habits see a higher demand for gas.

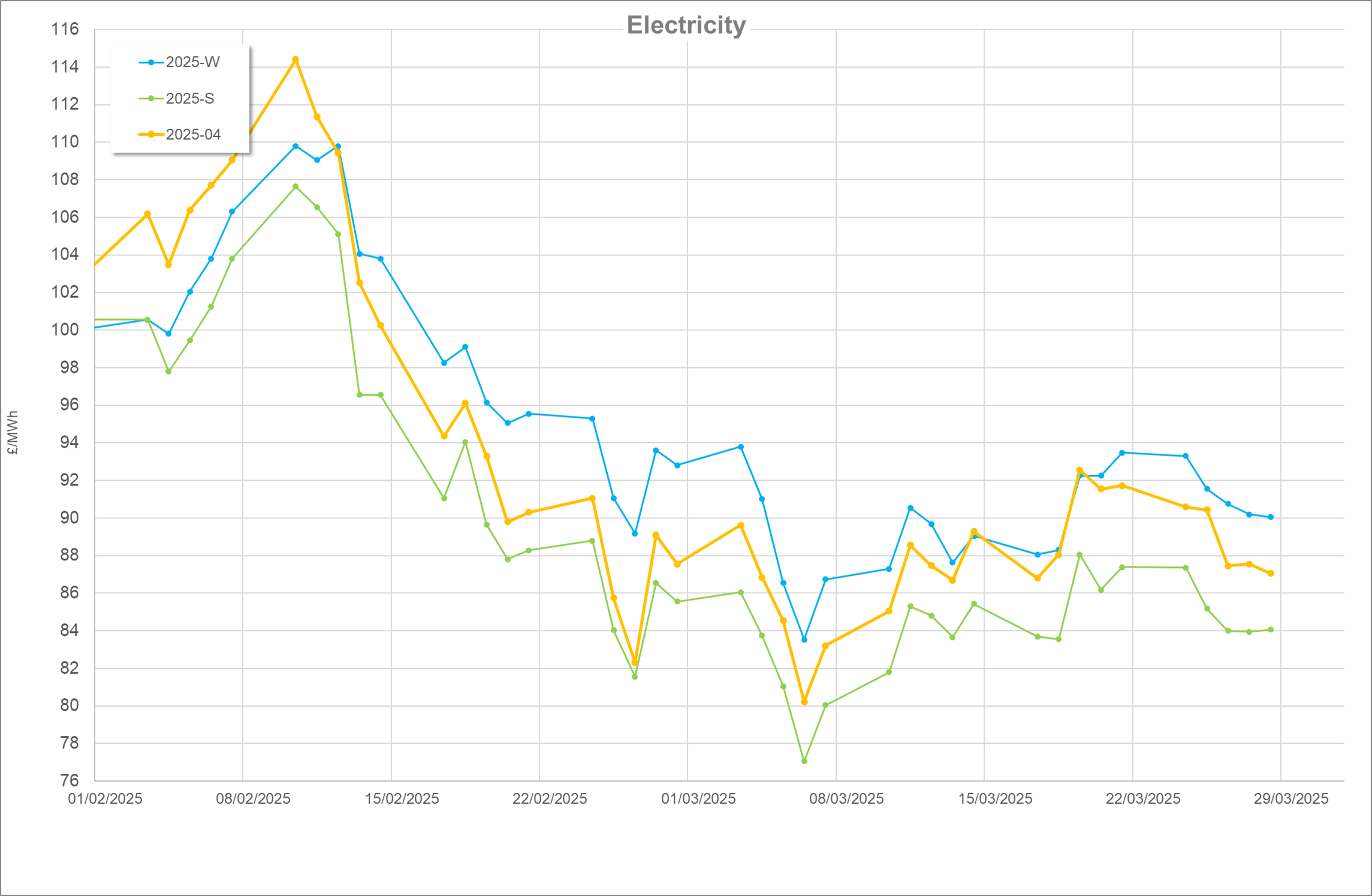

Norwegian gas exports were relatively strong through the month as French export continued to be strong boosted by the recently commissioned Flammenville 3. As Europe came to terms with the exit of the remaining Russian gas into the continent, prices decline after spiking heavily at the end of the year. Donald Trump’s inauguration however, seemed to spark a spike in pricing following the series of rapid fire policies stirred the sentiment pot.

Although there is anticipation of increased LNG exports to the UK, Trump threatening wide-scale sanctions on Iran could see the Middle Eastern country blockade the Straight of Hormuz which is important for oil tankers. Ukraine’s armed forces reportedly attacked the Turkstream gas pipeline, although some Ukrainian outlets suggested this was false and Russian propaganda. There were, however, escalated attacks by Russia on Ukraine’s energy infrastructure, although President Zelensky was quick to state that power was still flowing through the nation. Either way, both of these stories added to some negative sentiment throughout the month. This was further exacerbated by NATO deploying warships and aircraft patrols following the recent damage to EstLink2.

Future Stories

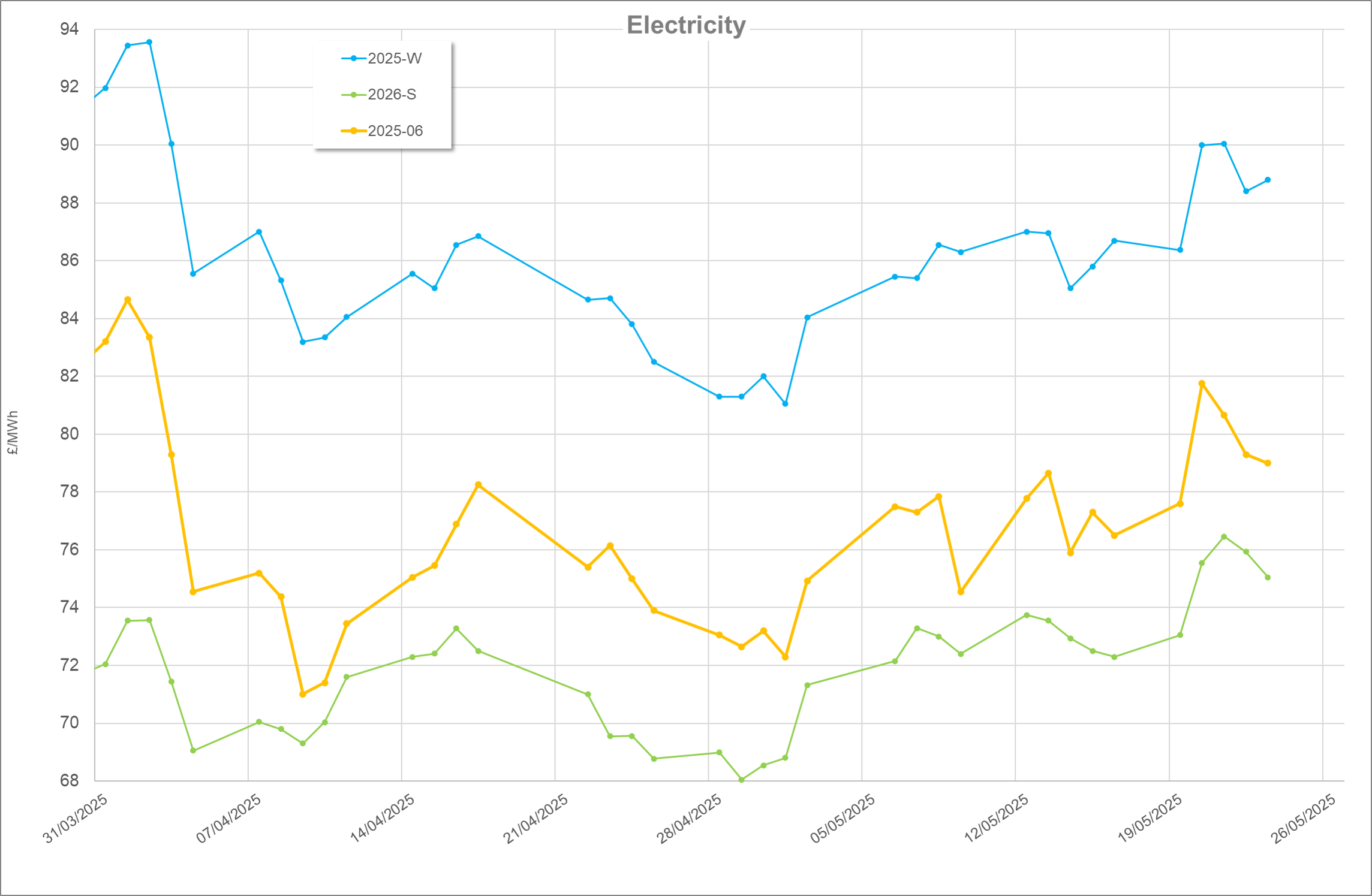

It is worth keeping a close eye on what the Trump administration does regarding the Ukraine, Middle East, and LNG to Europe. There are potential issues, both sentiment driven and fundamental driven, that could shake up market conditions. Although, in theory “Drill Baby Drill” will help UK’s energy balance, political strife could undermine any fundamental benefit.

Low gas storage stocks are a concern particularly as the UK has generally low levels compared to our North West European neighbours.

Below-average renewables in January have cut short any celebrations of 2024 being the first year where wind out-performed gas. With key interconnectors down between the UK and France and the Netherlands, any additional delays to their restoration could be problematic.

Written by Ed Kimberley