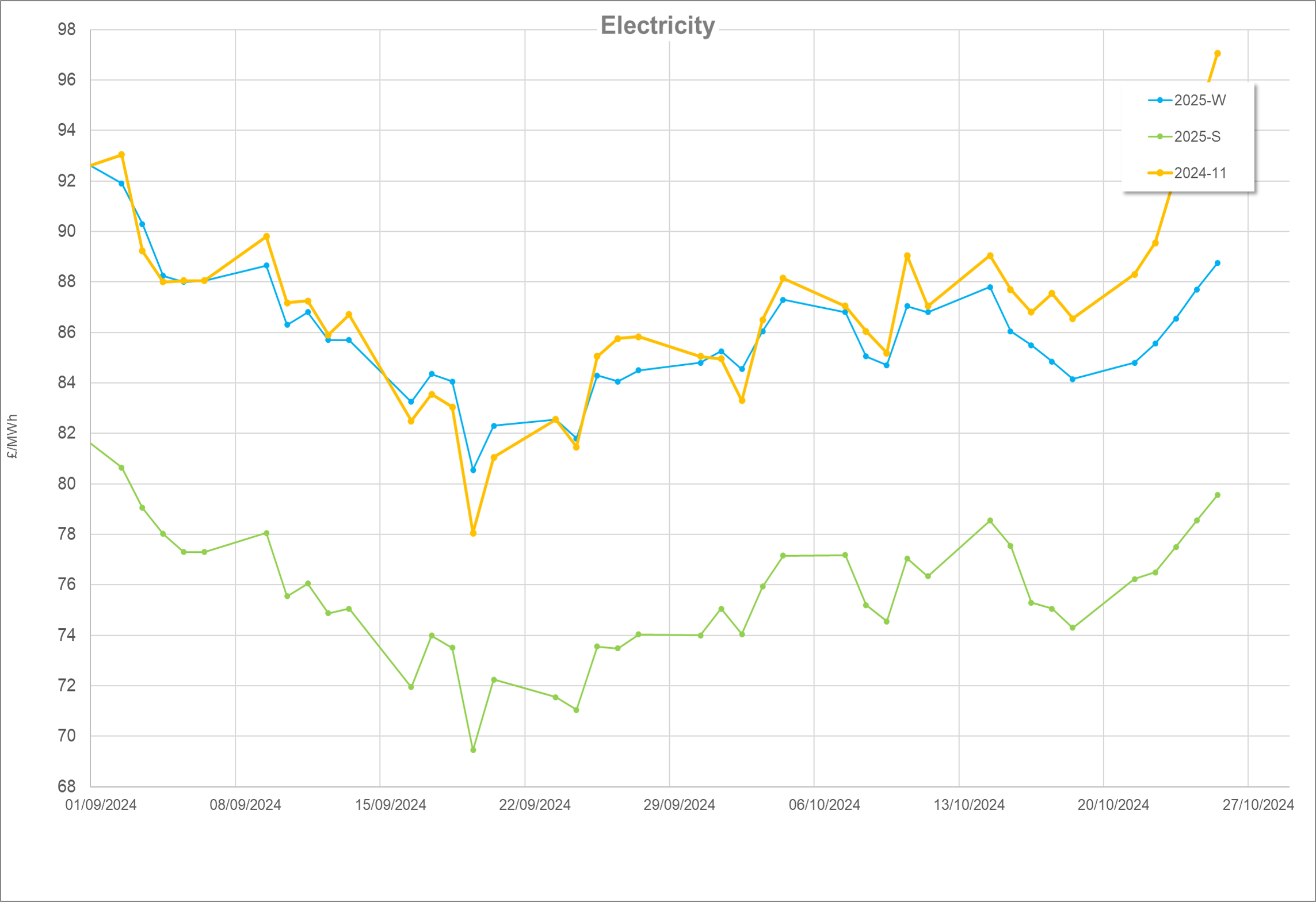

October Recap

In October, gas and electricity prices saw a continued rise from September, then plateaued, before spiking towards the end of the month. The main factors driving these increases were significant developments in the conflicts in Ukraine and the Middle East. In Israel, military action intensified as troops moved into Lebanon to expel Hezbollah forces. Following this, Israel carried out the assassination of key Hezbollah figures, prompting Iran to launch a large-scale aerial attack on Israel. Much like in April, when both countries had exchanged strikes, market prices reacted negatively. Although an Israeli response was anticipated, uncertainty led to price fluctuations until Israel’s retaliation late in the month, which resulted in a sharp price rise.

Meanwhile, in Ukraine, Russian forces captured the strategically important town of Vuhledar, adding further volatility to the situation. Norwegian gas outages were also reported throughout the month.

As temperatures fell and gas demand exceeded seasonal averages for the first time in 2024, the conditions for lowering prices were constrained. Despite this, the UK showed there was enough gas in circulation, with storage levels rising slightly, although it ended the month in a weaker position than in 2023.

Freeport LNG resumed production after hurricane-related shutdowns, and the UK benefited from a steady stream of LNG during the month. The UK also experienced Storm Ashley, which brought strong winds, helping to boost wind power generation. Wind energy again led the generation mix, contributing 33% of total power compared to 29% from gas, marking another strong month for renewables overall.

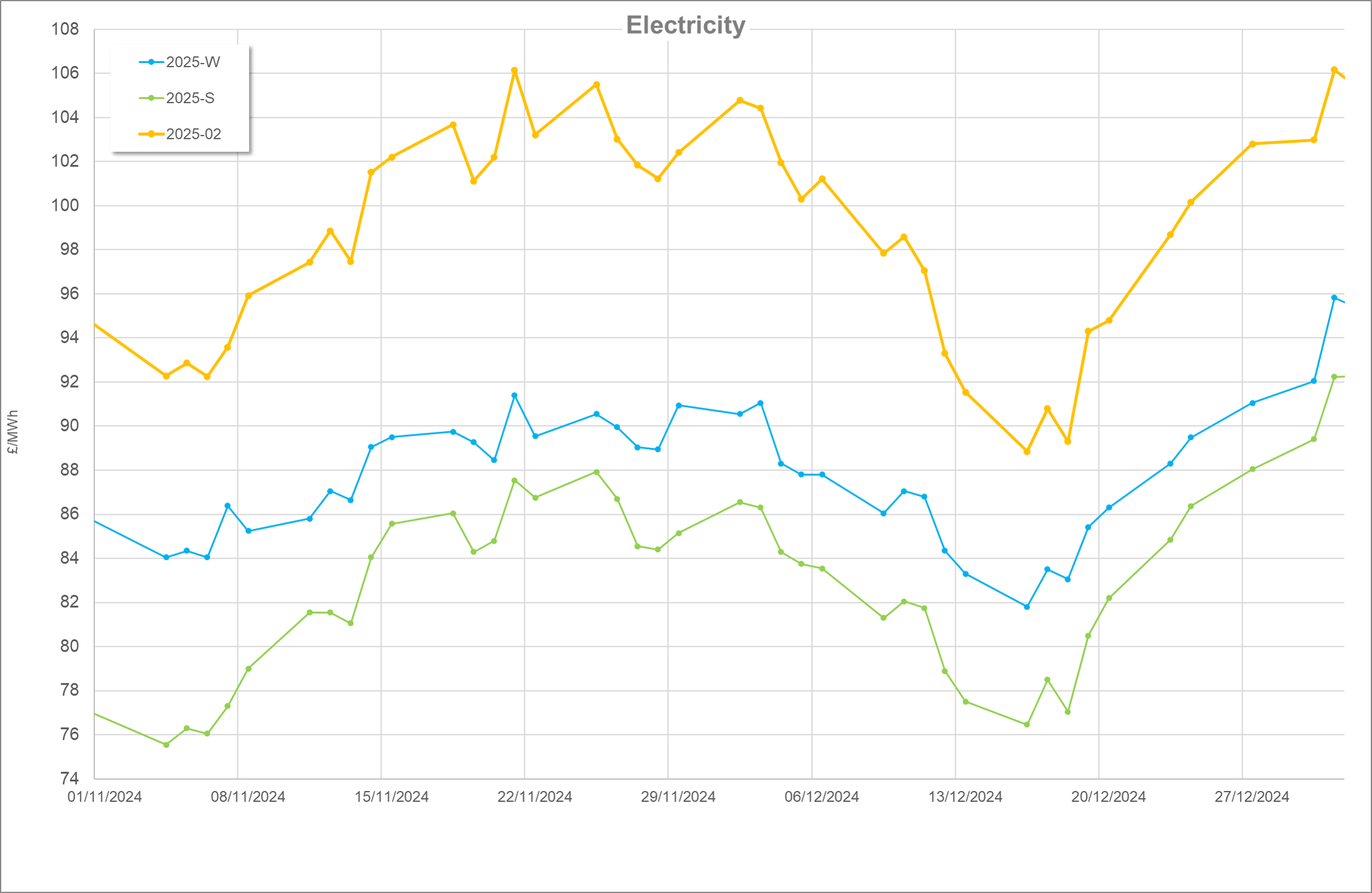

November Recap

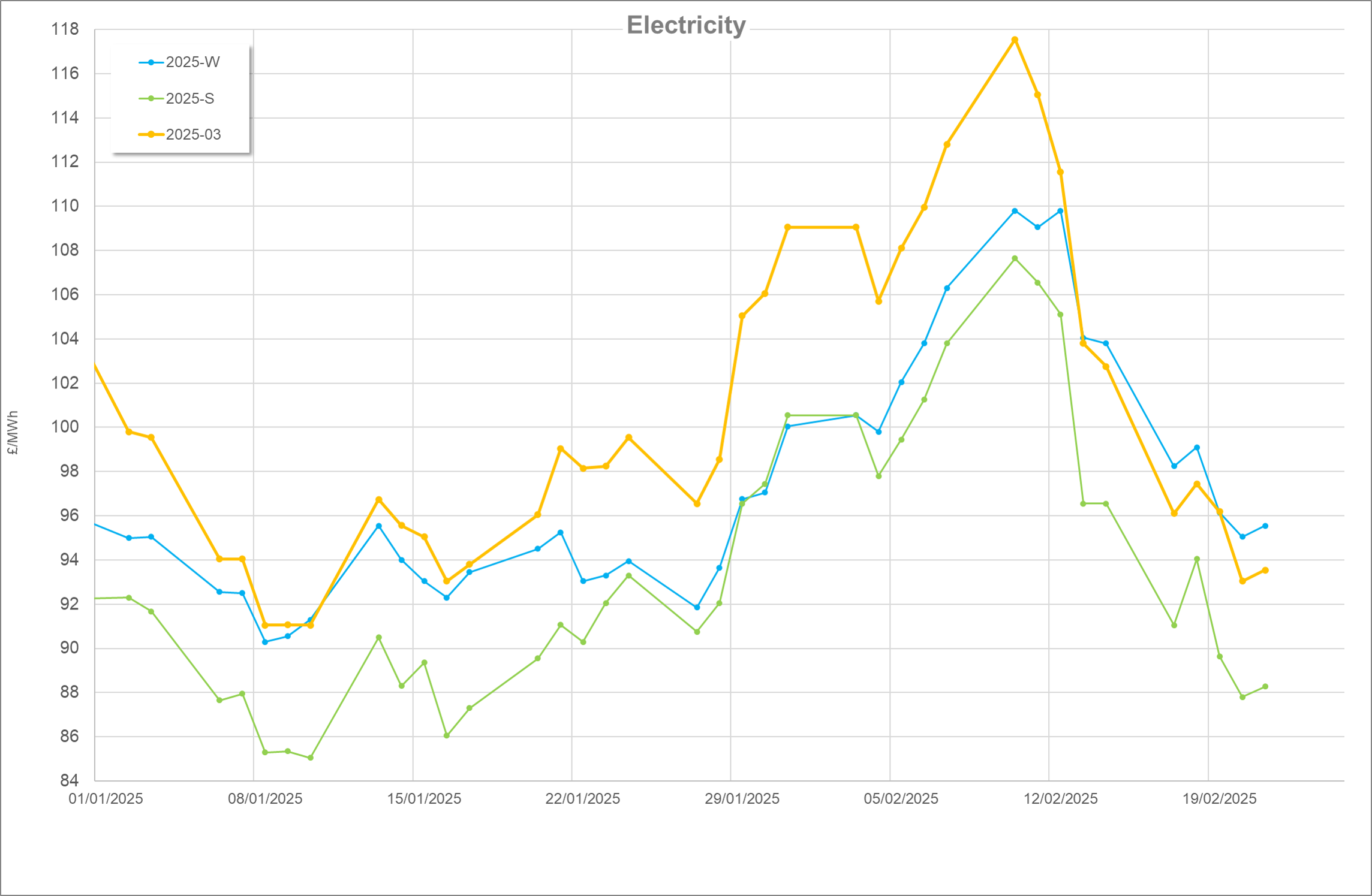

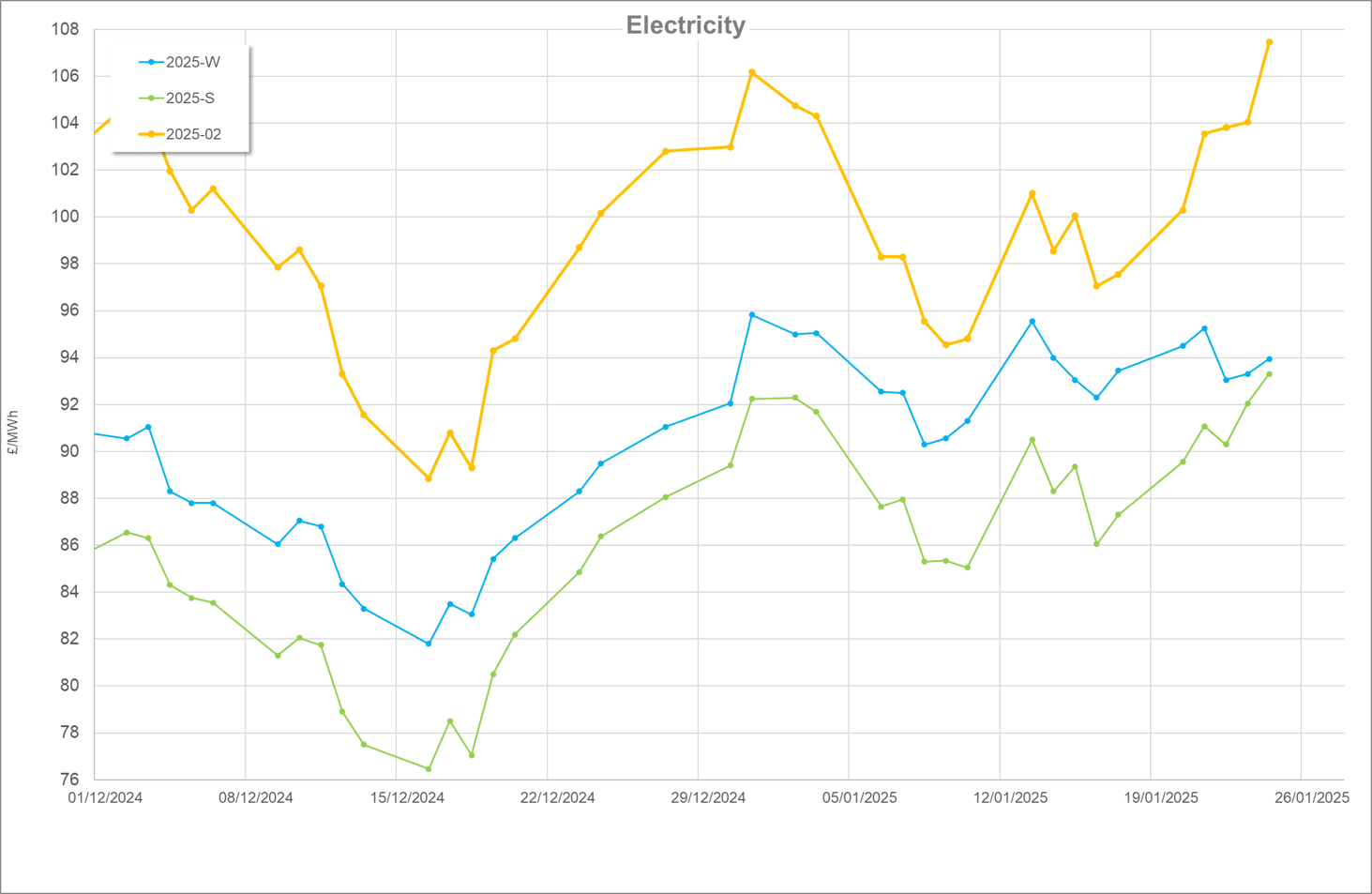

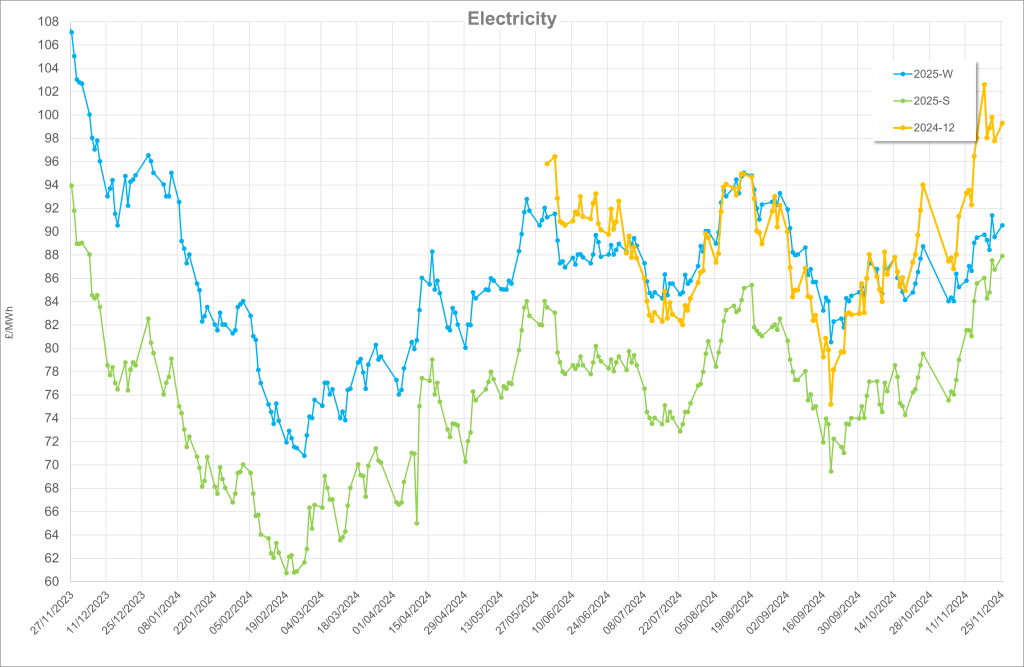

Throughout the month, energy prices saw significant fluctuations, driven by a combination of weather patterns, geopolitical tensions, and changes in supply-demand dynamics. Electricity prices for Summer 2025 saw a marked 8% increase, ending the month at £86/MWh, while Winter 2025 prices rose 5% to £90/MWh. December 2024 prices surged 7%, closing at £98/MWh. The sharp increase in electricity prices was influenced by colder weather and tightening market conditions, as well as market nervousness around ongoing geopolitical issues.

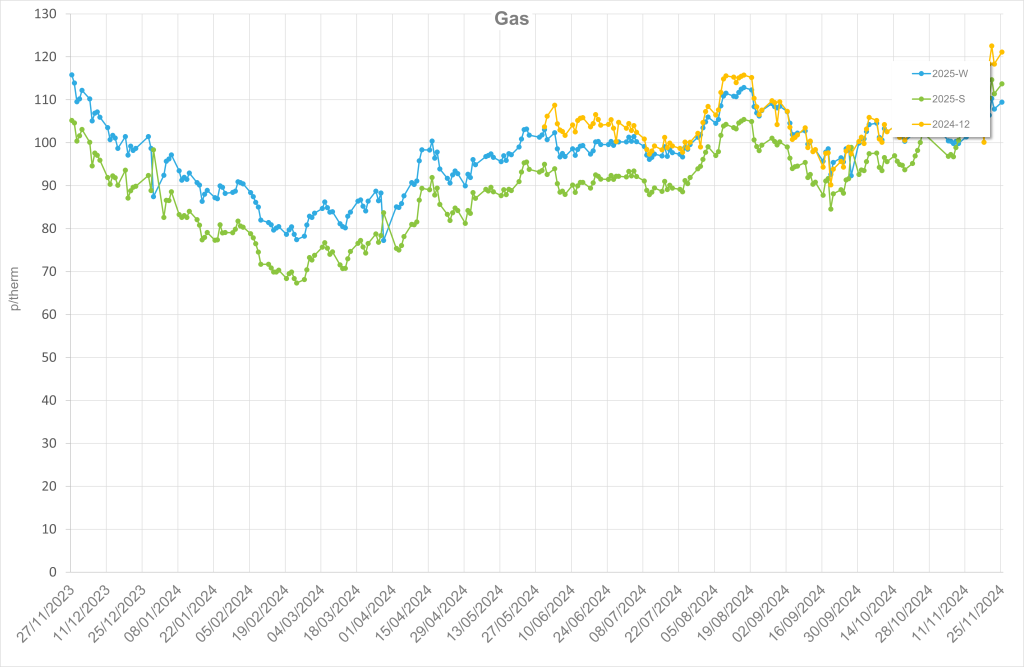

Gas prices followed a similar upward pattern, with Summer 2025 prices jumping 9% to 109p/therm, Winter 2025 rising 7% to 107p/therm, and December 2024 gas prices increasing by 9%, finishing at 118p/therm. These price rises were fuelled by both increased demand due to colder temperatures and uncertainty surrounding the Russia-Ukraine conflict, which weighed on market sentiment.

Despite the colder temperatures, renewable energy sources helped take some of the pressure on gas supply. Wind production exceeded seasonal averages, with both onshore and offshore wind generation performing well in the last 2 weeks of November. This increase in wind power helped offset higher gas consumption, keeping the overall energy mix balanced. Solar generation, while not at its peak, continued to contribute despite cloudy conditions, though it was impacted by the season’s typical weather disruptions.

The Russia-Ukraine conflict remained a significant source of market volatility. Geopolitical developments, including the authorization of longer-range missile support to Ukraine by the US, France, and the UK, further increased market nervousness. Fears around Russian gas supplies resurfaced, especially with concerns over the critical Sudzha metering station and rising tensions between Russia and the West. In response, the US considered sanctions on Gazprombank, and issues with Russian gas deliveries made headlines, though some of these were steadied by stable Norwegian gas flows and strong LNG imports to the UK.

While the cold snap and snow towards the end of the month brought a surge in heating demand, the UK maintained a stable gas supply thanks to strong flows from Norway and six LNG cargoes expected throughout the month. The first significant cold snap of the season also caused some fluctuations in storage, but renewable generation from wind towards the end of the month helped to reduce gas burn, preventing major storage issues.

Looking Ahead

The month closed with expectations of Storm Bert bringing strong winds and heavy rain to the UK, potentially impacting both weather and energy markets as the country faced further pressure on its energy supply and demand. As we move into the next month, weather conditions and ongoing geopolitical tensions will continue to play a significant role in shaping energy prices and market sentiment – one on the radar to look out for in December is the Russian gas deal with Slovakia that comes to an end on 31st of December.

This update was written by Gemma Riley