September Recap

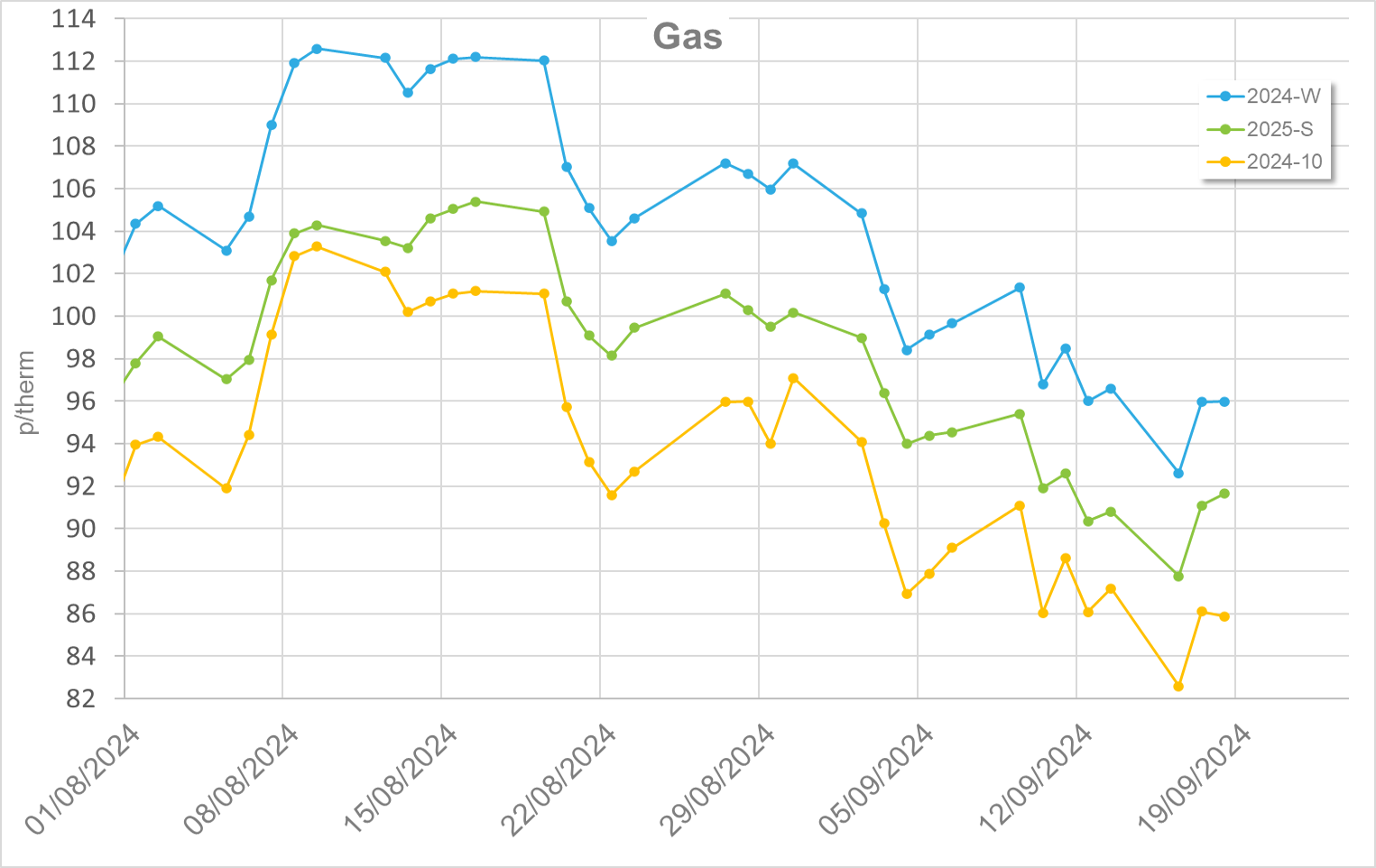

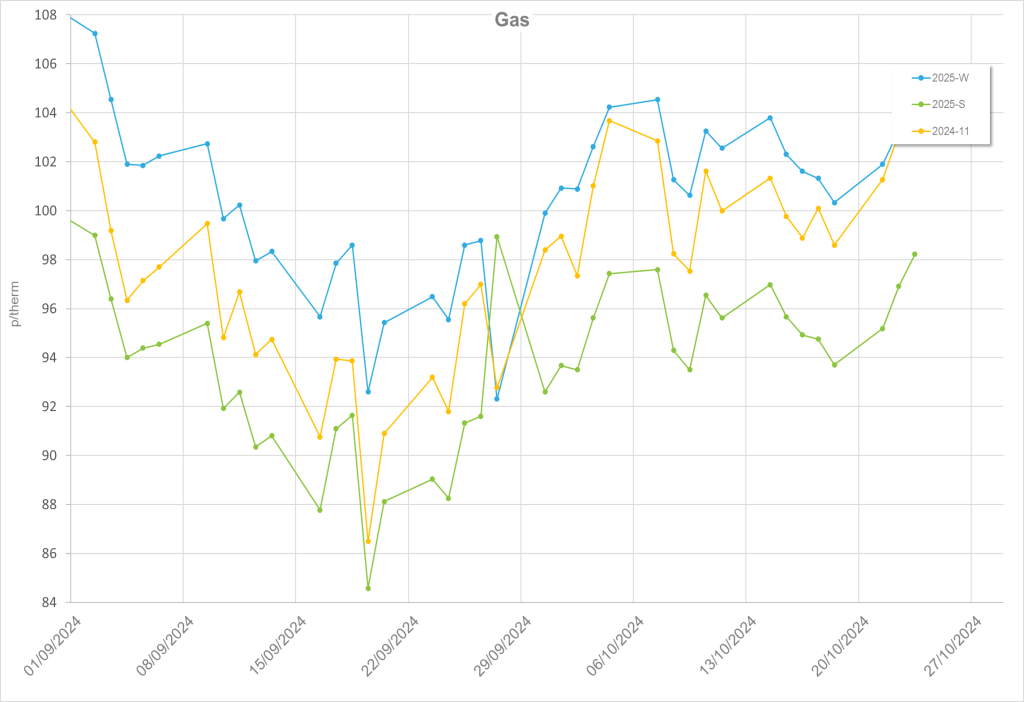

Contrary to the last update written a few days before month close, a late surge in wind generation saw our turbines beat gas to the final post for the top generator, albeit it was close. September typically marks the second round of Norwegian maintenance. After a somewhat turbulent 2023 maintenance window, the markets were looking for outages to run to schedule. Sadly, this was not the case with numerous unplanned outages and extensions to planned works being announced.

As expected, the UK called upon its gas storage to mitigate the missing Norwegian gas, however withdrawals stayed relatively low and the position stayed consistently above that in 2023. Although temperatures steadily decreased throughout the month, it remained, on the whole, a mild month. Gas consumption remained below seasonal averages and there was less pressure to burn gas for power during spells of weak renewables.

Markets welcomed talk of a transit deal for gas between Azerbaijan and Ukraine after the markets responded poorly to the Ukrainian armed forces capturing the crucial Sudzha metering station. Hurricane season was prevalent in North America with Hurricane Helene causing the Freeport LNG facility to close, temporarily limiting crucial LNG to the UK.

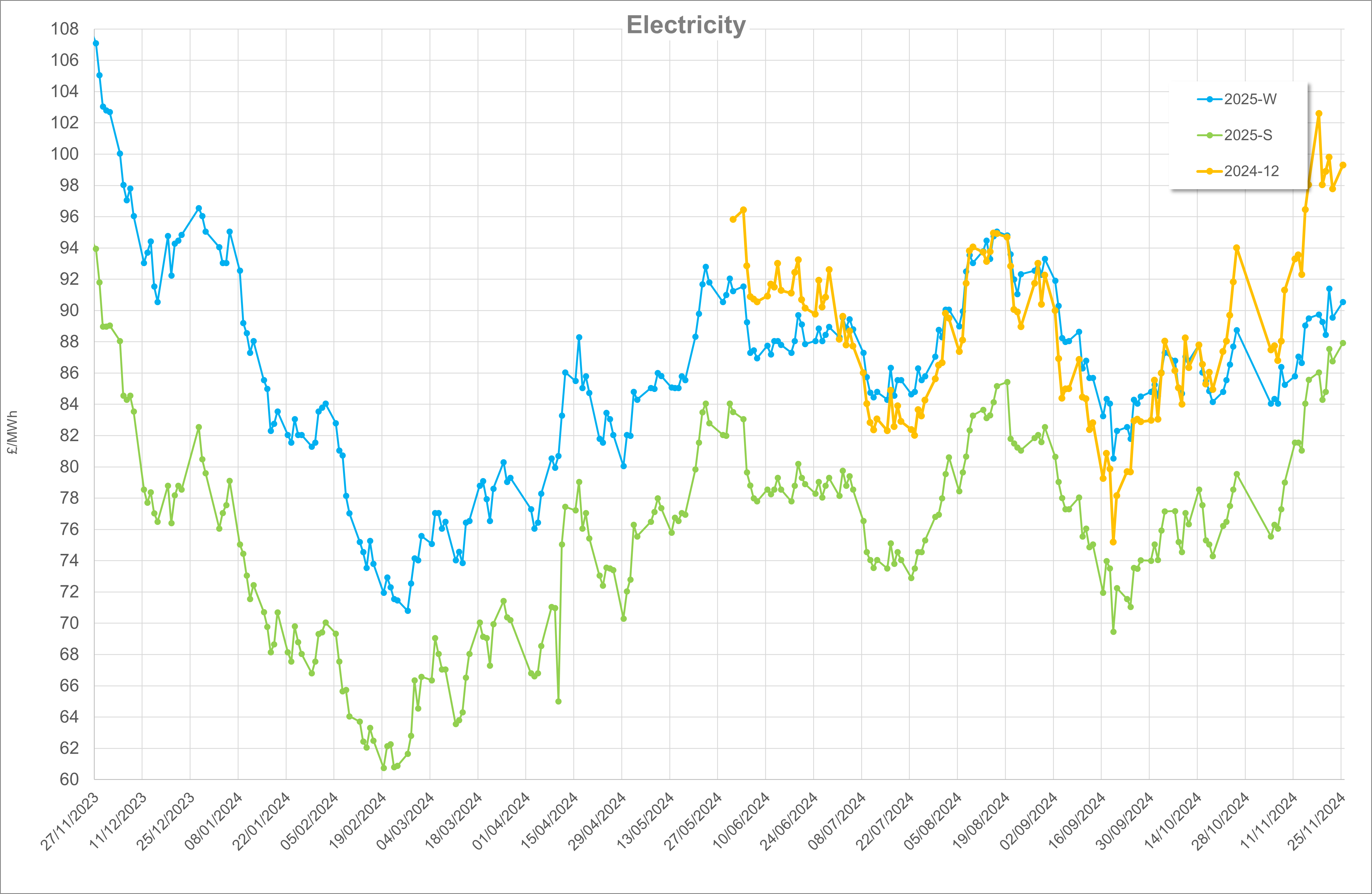

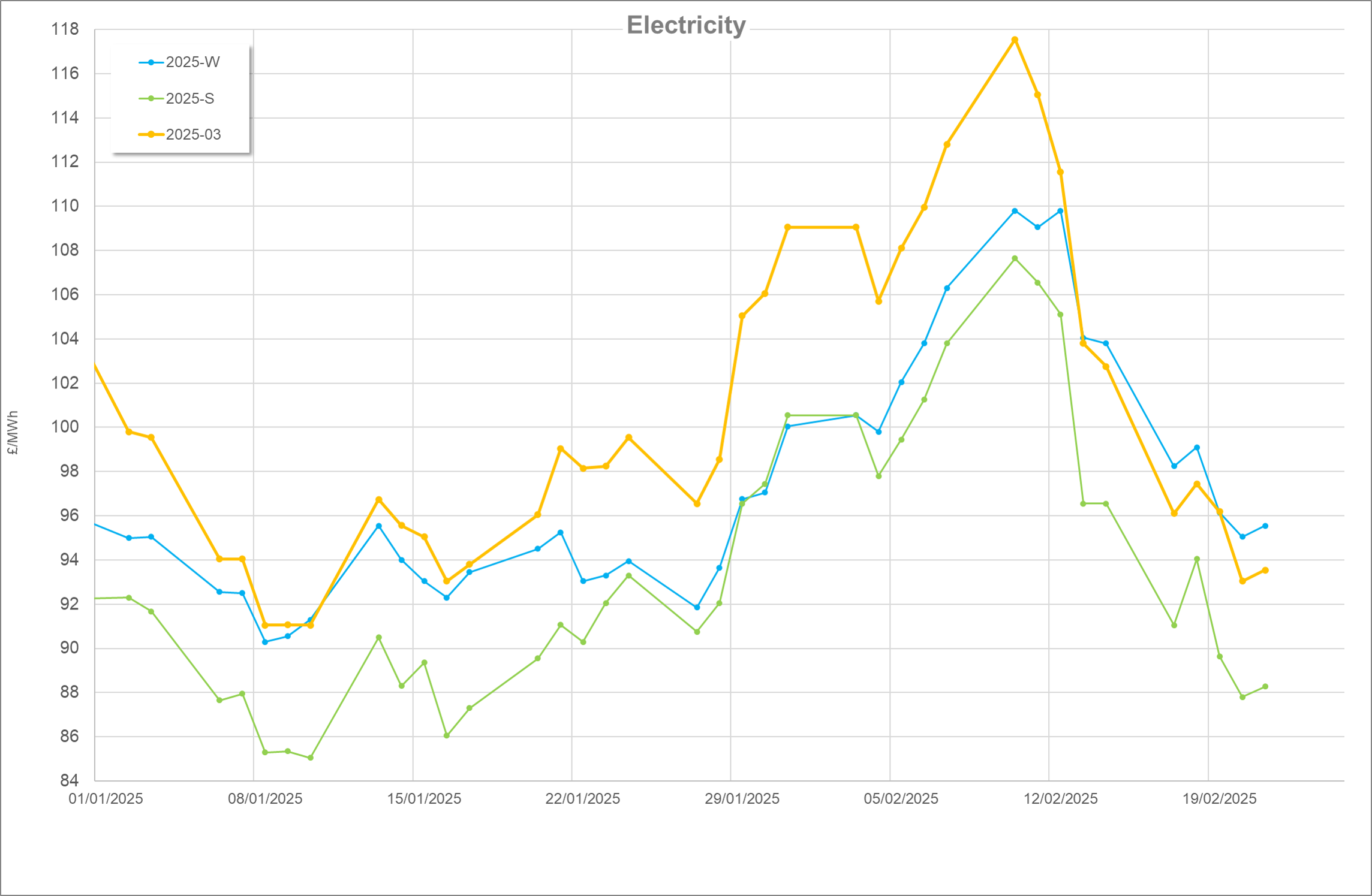

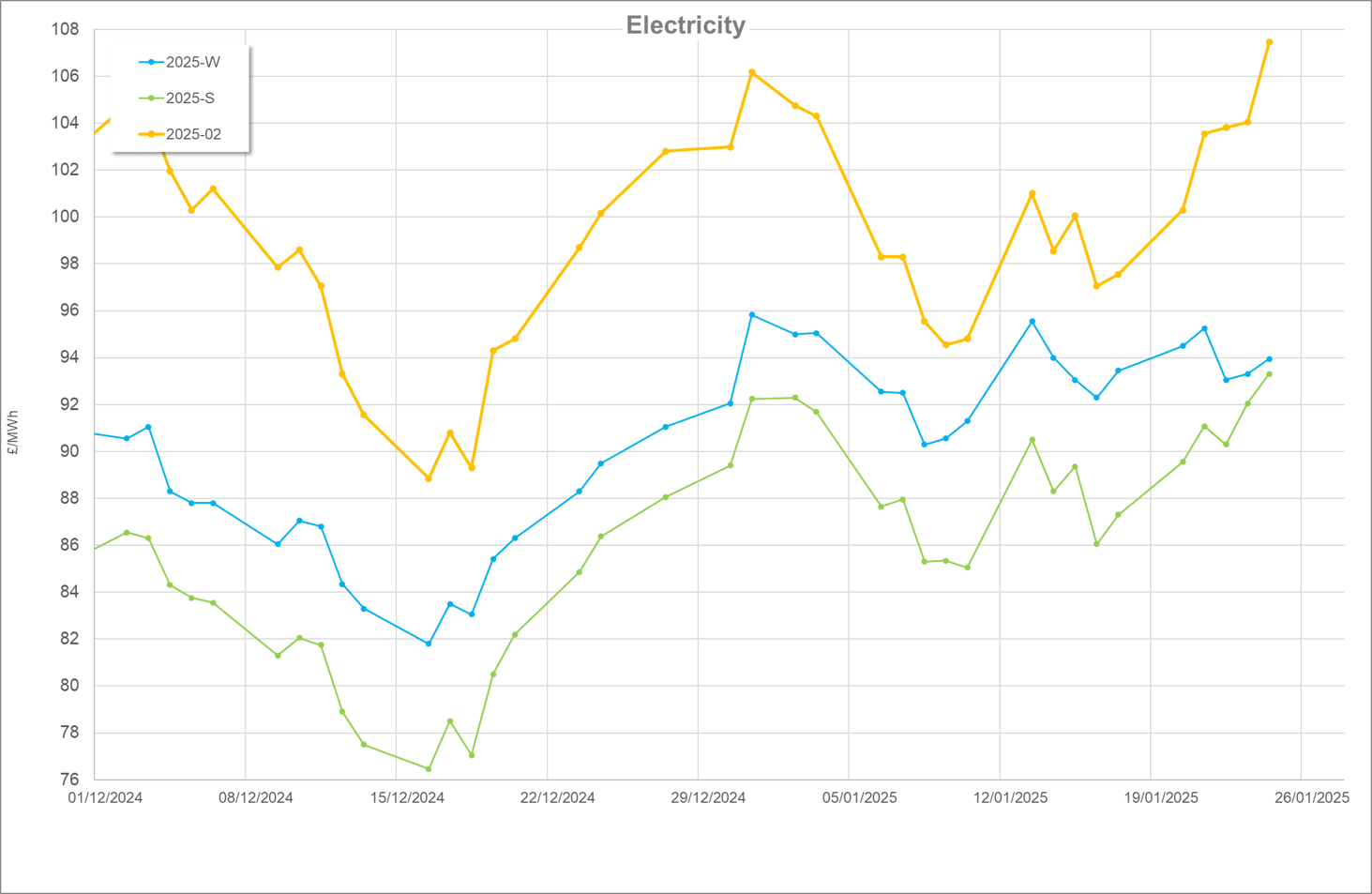

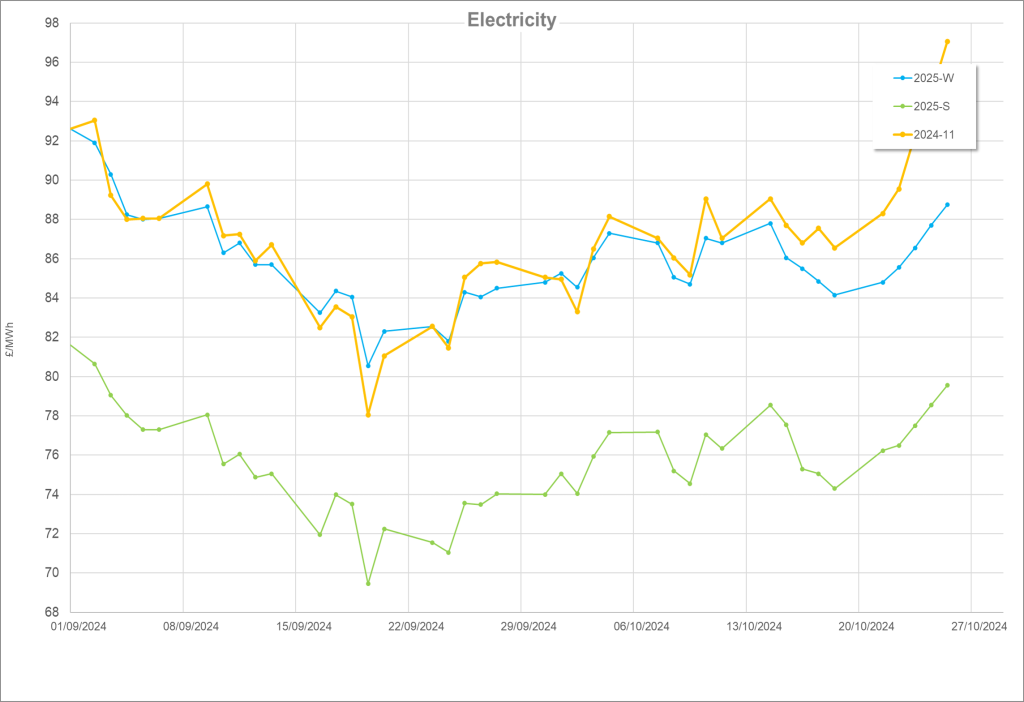

In particular, we saw prices reacting to Norwegian maintenance and the ongoing geopolitical situations in Ukraine and the Middle East. Despite good fundamentals, the proximity to the winter trading period seemed to exacerbate the market’s nervousness. While prices in electricity generally followed the trend of gas, reducing early in the month before rising around the midway point, the swings intra-day were less pronounced.

October Recap

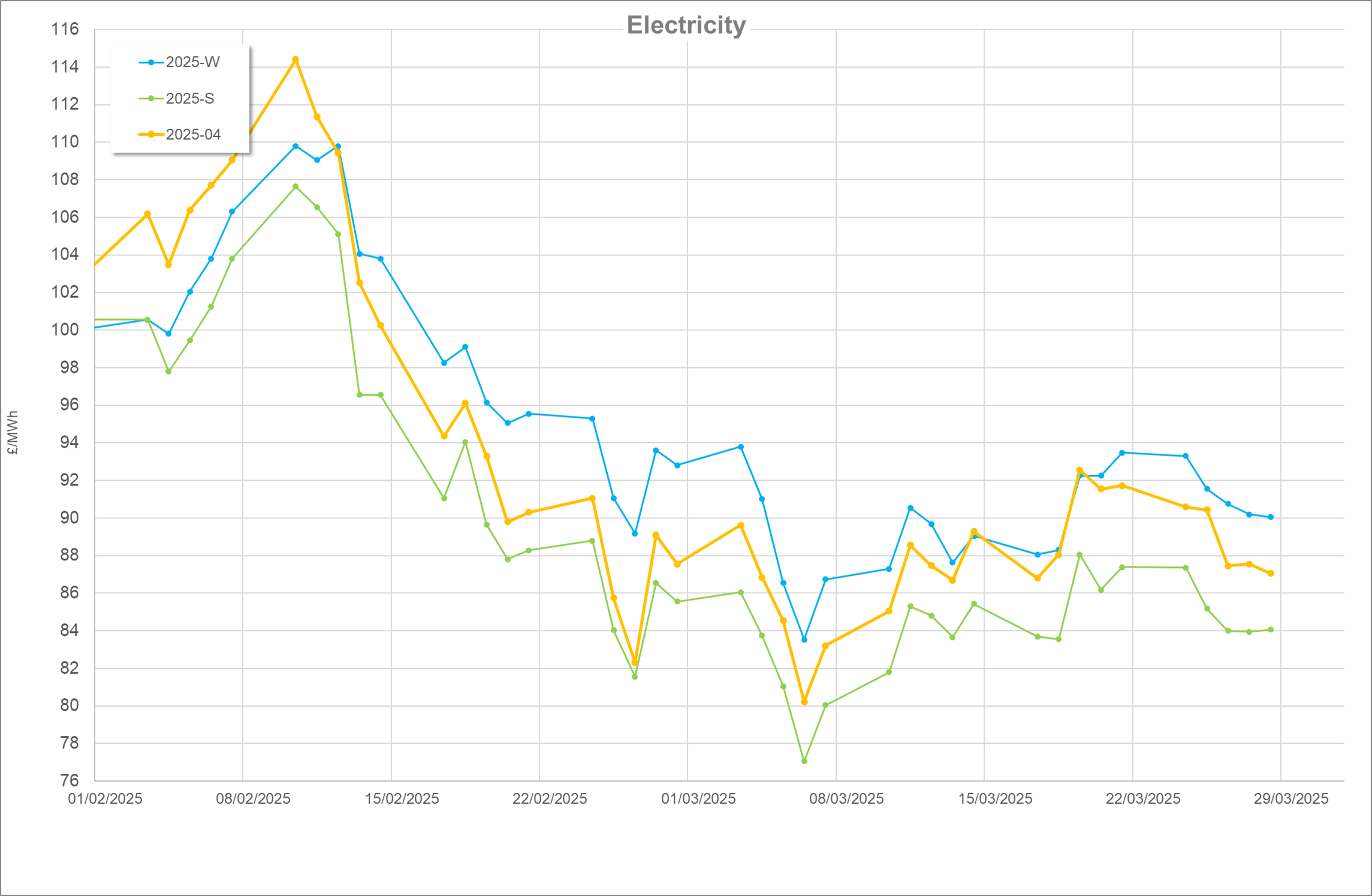

Pricing in October for both gas and electricity continued to rise out of September, plateaued, then rose dramatically towards the end of the month. In both Ukraine and the Middle East, significant developments in the respective conflicts were the main drivers of price increases.

Israel moved troops into Lebanon with the view to drive Hezbollah forces in the region out. Following this and the Israeli led assassination of several key Hezbollah figures, Iran launched a sizeable aerial assault on Israel. Similar to April this year where both nations launched strikes on each other, prices reacted poorly. An Israeli response was predicted and nervousness was seen in the pricing until its retaliation late in the month. This was a significant event that, despite being predicted, saw price increases. Meanwhile, in Ukraine, Russian forces captured the strategically significant town of Vuhledar.

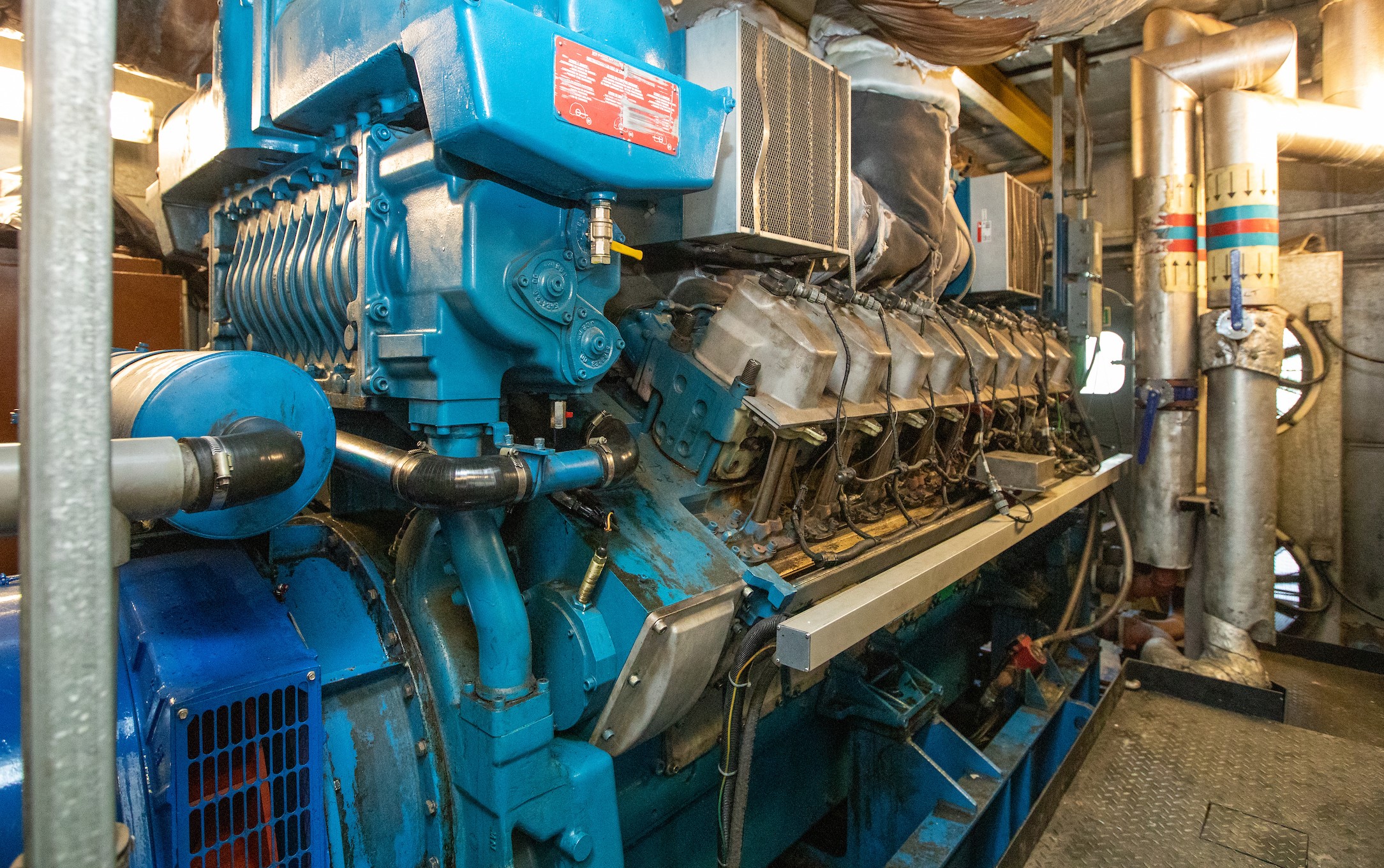

Additionally, Norwegian gas outages popped up throughout the month. With temperatures falling and gas demand rising above seasonal averages for the first time in 2024, conditions for price reductions were severely hampered. That said, the UK proved there was sufficient gas floating around as storage levels gently increased, although 2023’s position ended the month stronger than 2024’s. Freeport returned to production after hurricane season caused temporary shut downs at the facility and the UK benefitted from a steady stream of LNG throughout the month. Meanwhile, the UK was hit by Storm Ashley which saw some strong wind conditions benefitting wind turbine generated power. Wind again finished on top of the generator stakes, 33% compared to 29% from gas showing another strong month overall for renewables.

Looking Ahead

As the Winter 24 trading period gets into full swing, the markets have shown some nervousness as power and gas demands typically increase. After a mild 2023 and 2024 (so far) any significant downturns in temperature could rock prices.

Geopolitics in Ukraine and the Middle East both continue to be significant price drivers. Should any further escalations be observed in either region price increases will likely follow.

The US election is upon us with Donald Trump running against Kamala Harris. A Trump victory may over the next term help UK energy security as it is likely Trump will want to continue fossil fuel projects that could export LNG in particular to the UK. That said, the sentiment of a victory for either party and its effect on the UK Energy Pricing is yet to be seen.

This update was written by Edward Kimberley