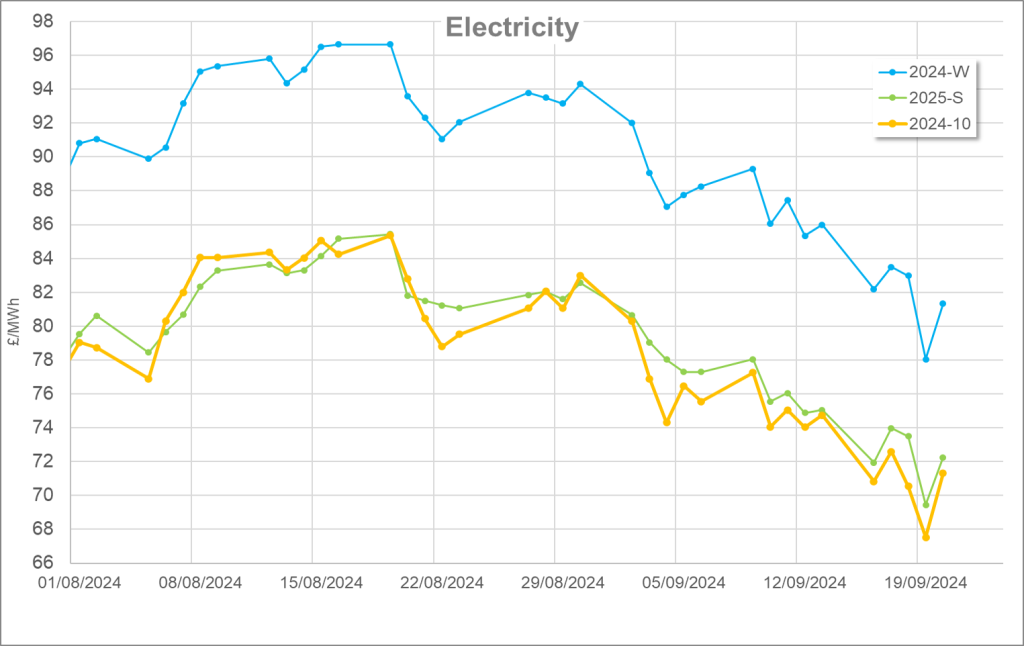

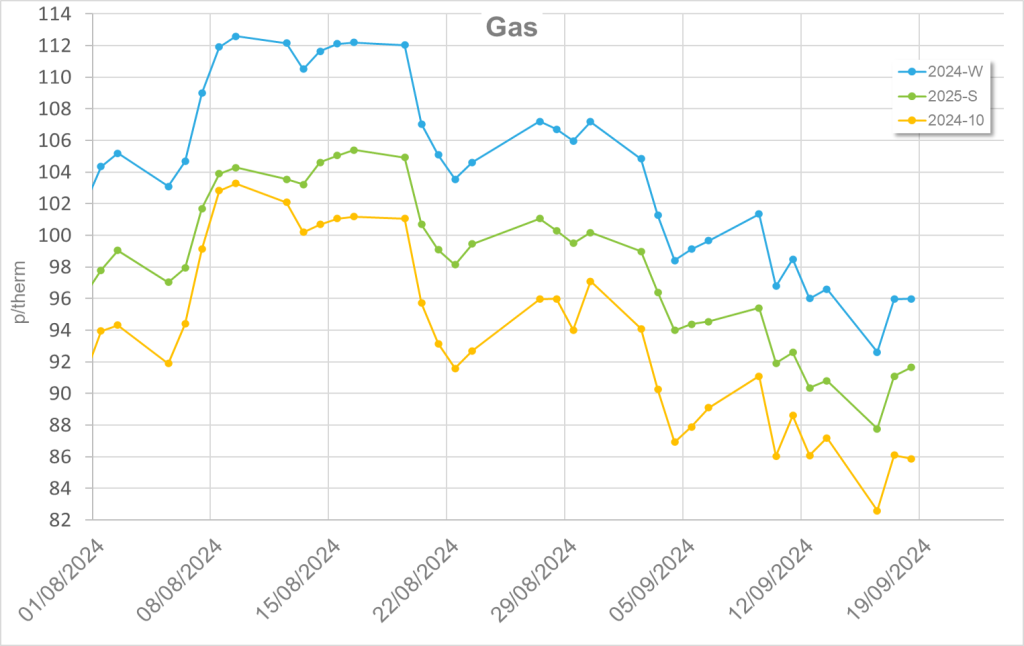

August Recap:

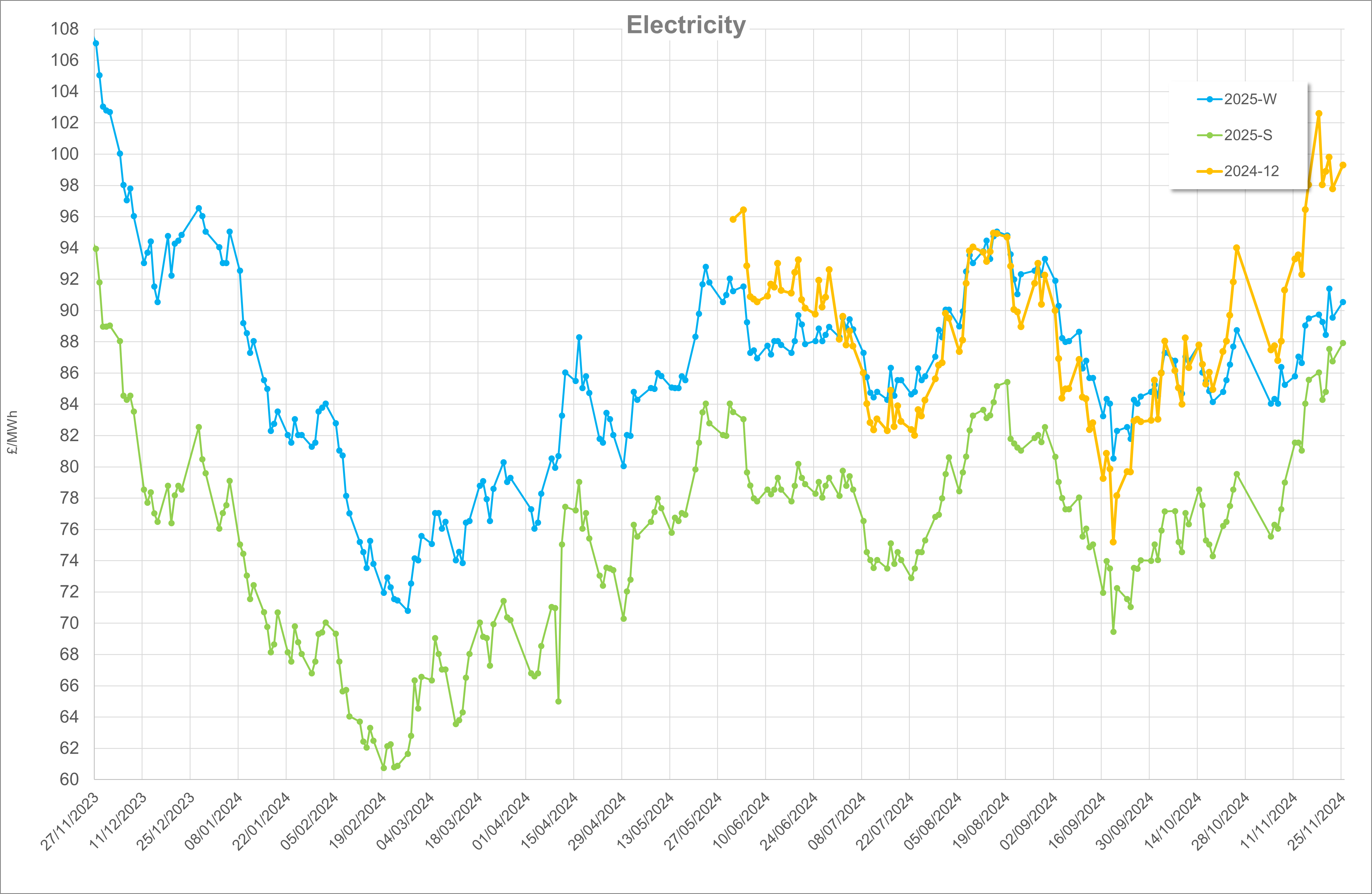

August represented a solid month for the fundamentals in the market. Despite the beginning of intense Norwegian gas maintenance at the end of the month, gas supply was healthy throughout the month with little demand, meaning large volumes of surplus gas were redirected into storage. This represented a ~5,000GWh increase on last year’s position and provided a counterpoint for any stories that could raise prices. Gas for power demand was also low due to strong renewable outputs with wind producing twice the power of gas during the month.

The conflict between Ukraine and Russia took a surprising turn with Ukrainian armed forces capturing a portion of Russian territory in the Kursk region. This included the Sudzha gas metering point which is the gateway for the remaining Russian gas into Europe. Markets reacted badly to this news and prices increased over concerns regarding the ~40MCM/day that flows into Ukraine from Russia and what this would do to the supply mix.

Some market commentators pointed out that the contracts for this gas were ending at the end of 2024, and thus markets should be beginning to factor that in, similar to when their LNG contracts were hit with sanctions earlier this year. Hezbollah escalated strikes on Israeli territory which also increased prices due to rising destabilisation in the region.

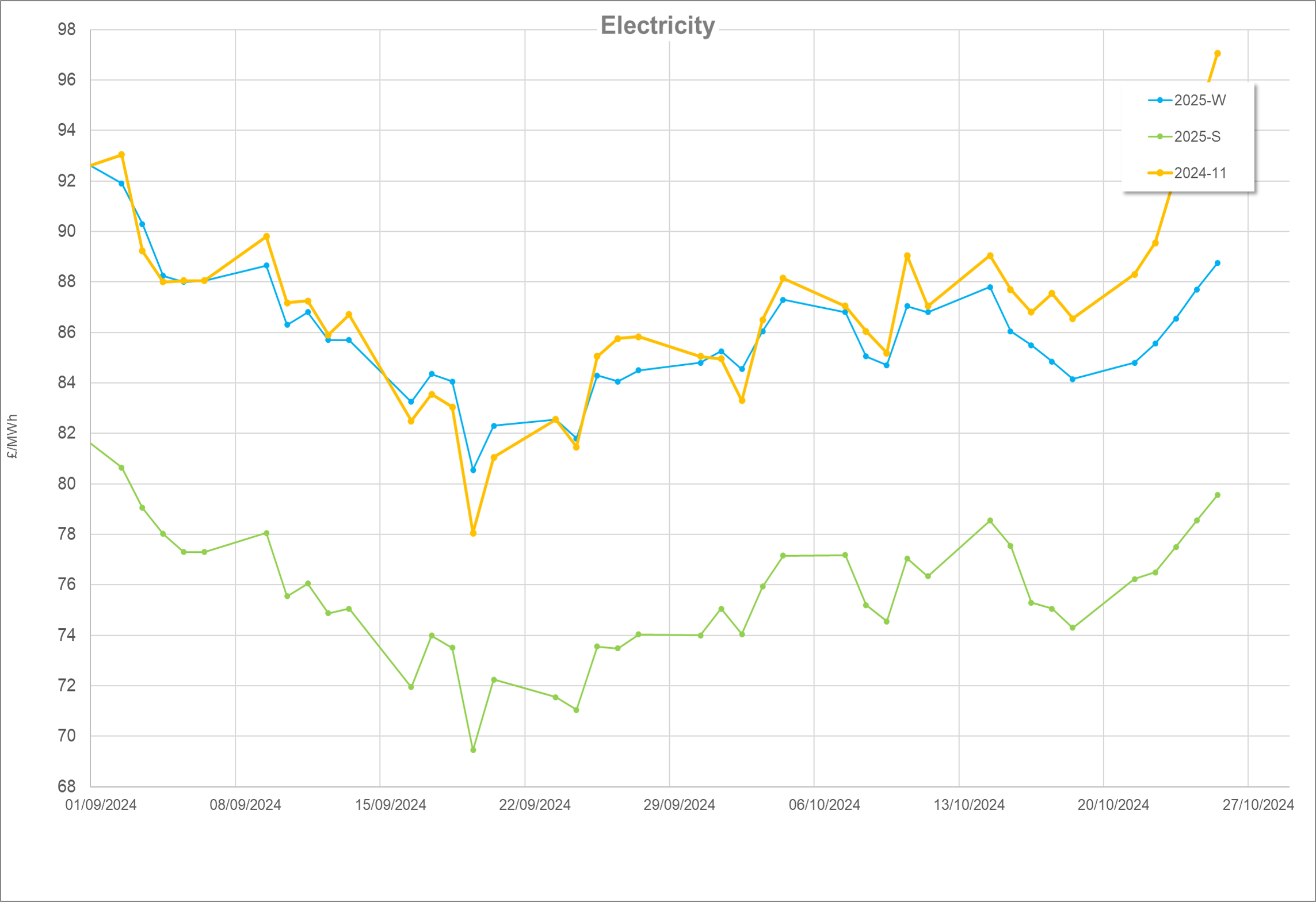

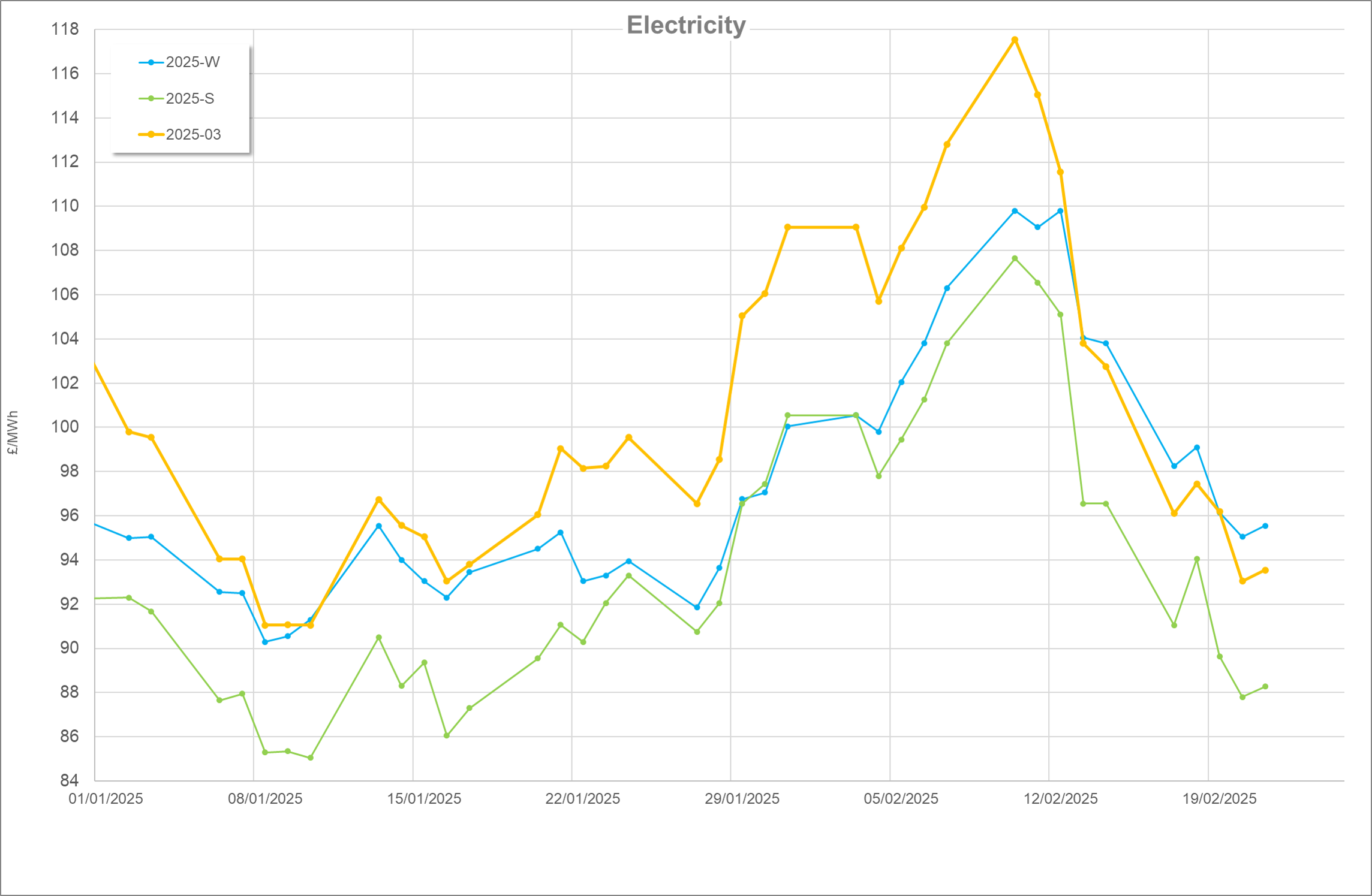

September Update:

After a strong renewables month in August, September saw gas beat wind to the post in terms of the largest electricity generator. Although this was marginal (~3%), it came at a time when Norwegian maintenance was in full swing and thus, relying heavier on gas when it was less available, acted to keep prices up.

In the early parts of the month, changes including extensions to the Norwegian maintenance were announced by Gassco. After a turbulent 2023 regarding Norwegian maintenance, the markets reacted nervously which kept prices up. However, as the month progressed, things settled down. Dribs and drabs of unplanned maintenance popped up throughout the month, although these were mostly short-lived with the markets largely shrugging these occurrences off.

The effect of the Ukrainian occupation of the Sudzha metering station on the markets began to erode as gas flowed uninterrupted to the benefit of both Russia and Ukraine. It was also announced toward the end of the month that a deal was in the works between Azerbaijan and Ukraine to replace the Russian gas contracts set to expire at the end of the year. Gas storage was called upon during the month at twice the rate of 2023. However, coming into the month, the 2024 position was far stronger with ~5000GWh of gas in storage and the month-end final position saw more gas storage remaining in 2024 than in 2023.

Gas storage in North West Europe was also in a strong position, with an average of 94% full, well ahead of the Nov 1st EU mandate of 90%. Hurricane season saw some shutdowns at the Freeport LNG facility during a time when the UK ramped up its LNG imports to offset some of the gas offline in Norway. Due to the strong fundamentals however this had little, if any, effect on price movements.

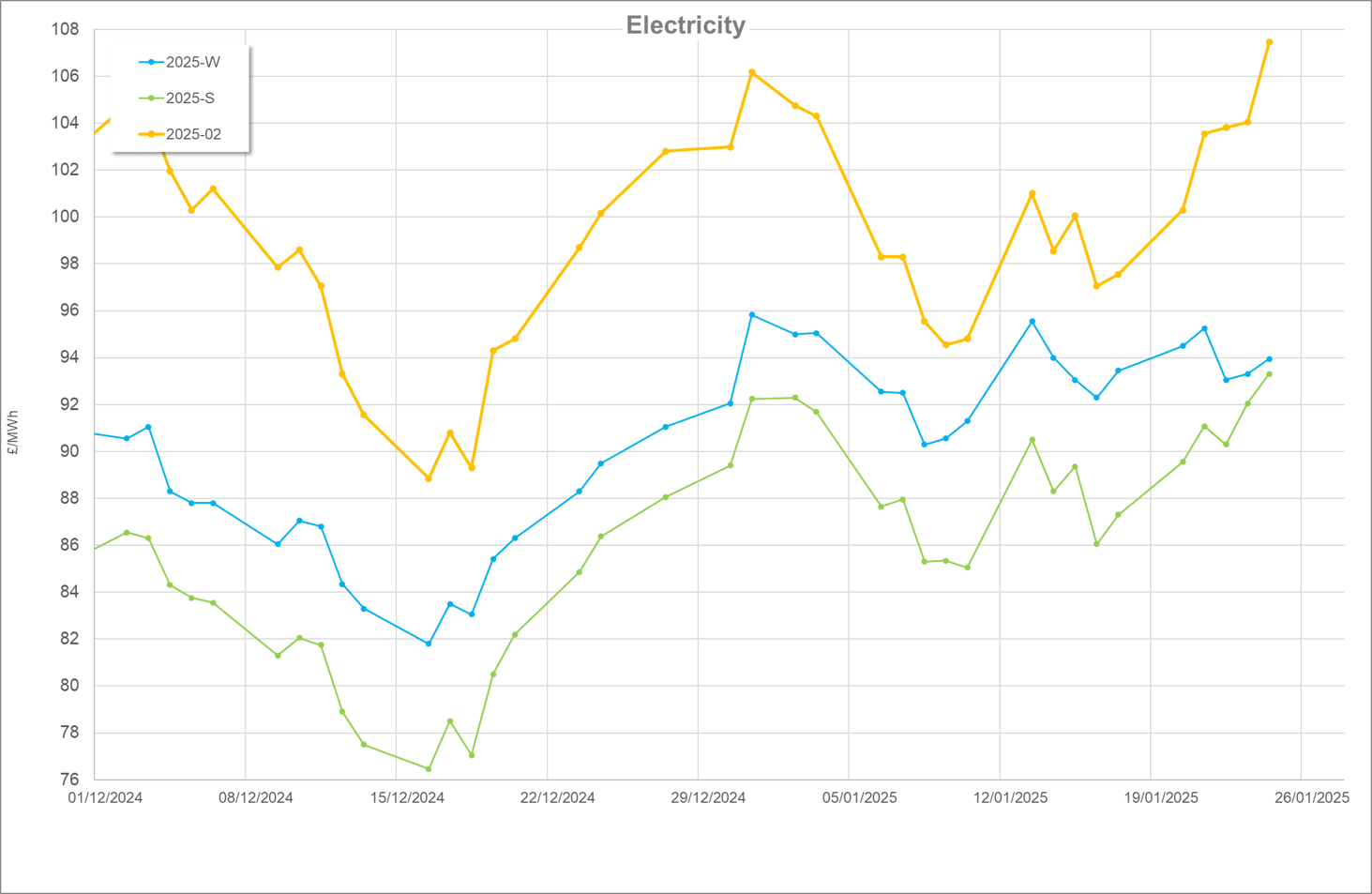

Looking Ahead:

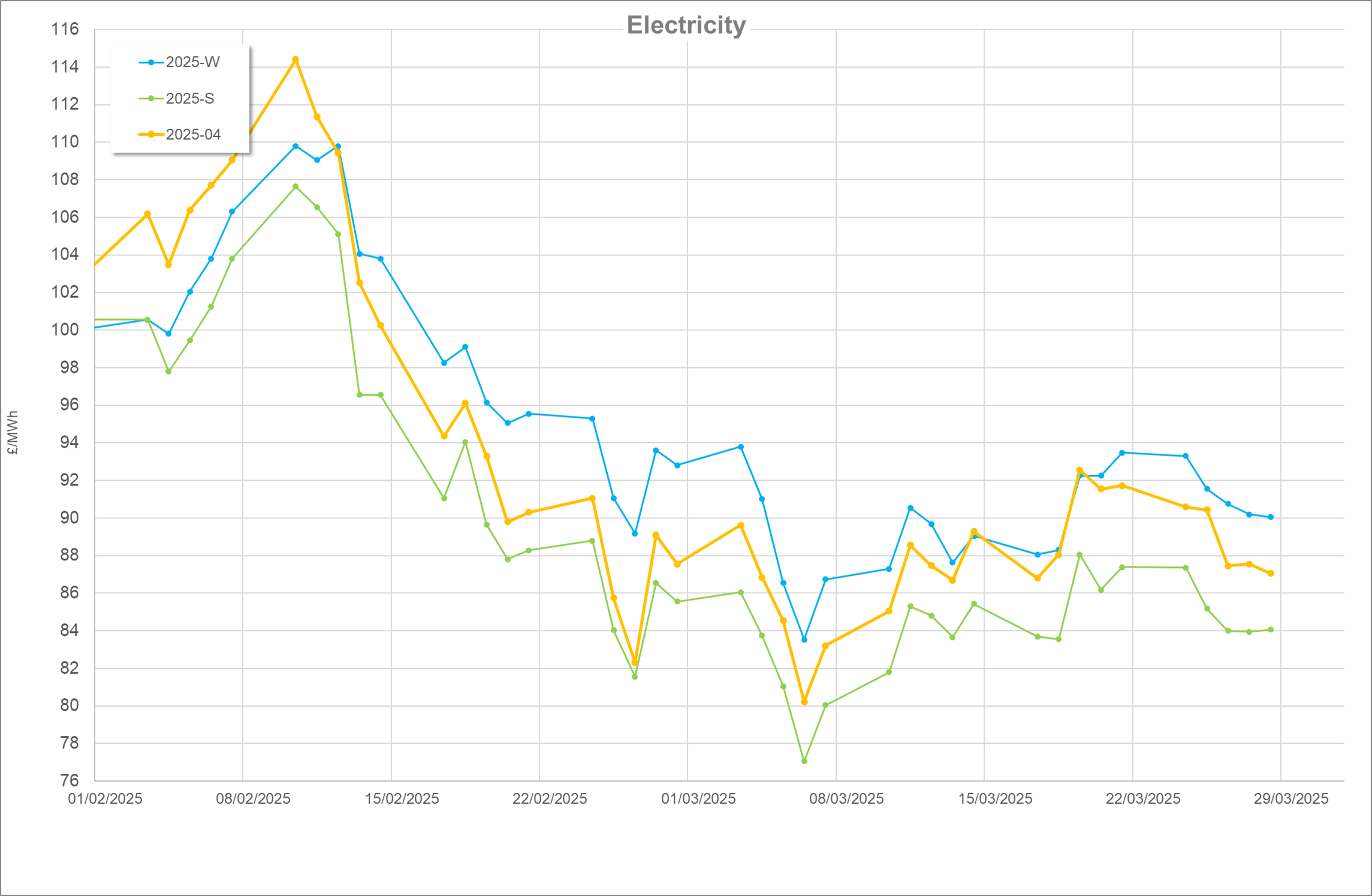

The winter trading season is upon us, 2023 saw mild temperatures which were undoubtedly at the core of general price reductions. This was a welcome relief in the immediate winter after the Energy Crisis. With sentiment still affecting the markets negatively, another mild winter might help reduce some of the lingering effects that it has.

The US election is in early November, so we will have to monitor the effects closely for any sentiment or long-term effects the result will have on prices.

A new 450MW wind farm off the coast of Scotland, Neart Na Gaoithe, is expected to be complete and commissioned towards the end of 2024 with a further update expected shortly.

This update was written by Edward Kimberley